Posts by Rickie Houston CEPF®

How Depreciation Recapture Works on Your Taxes

When you sell a depreciated capital asset, you may be able to earn a “realized gain” if the asset’s sale price is higher than its value after deduction expenses. You’ll then be able to recapture the difference between the two… read more…

401(a) vs. 401(k): What’s the Difference?

Interested in investing in your retirement? You know you should be socking money away for your golden years, but you need to understand the savings vehicle your employer offers. The 401(k) plan, which for-profit employers offer, is a popular way… read more…

Liquid Net Worth: Definition and Calculation

As you assess your short- and long-term financial goals, it may be helpful to compare the value of your assets to that of your liabilities. That’s where net worth comes in; this value can ultimately help you determine whether you… read more…

What Is Term Life Insurance?

Life insurance offers your family and loved ones protection against any of your financial obligations after you’ve passed away. Though there are multiple forms of life insurance, term life policies provide your beneficiaries with a death benefit if you die… read more…

What Is a Contingent Beneficiary in Life Insurance?

It’s wise to select multiple beneficiaries when purchasing life insurance policies. This ensures that your family or loved ones can cover any financial obligations after you’ve passed away. The death proceeds from life insurance policies can have multiple uses, such… read more…

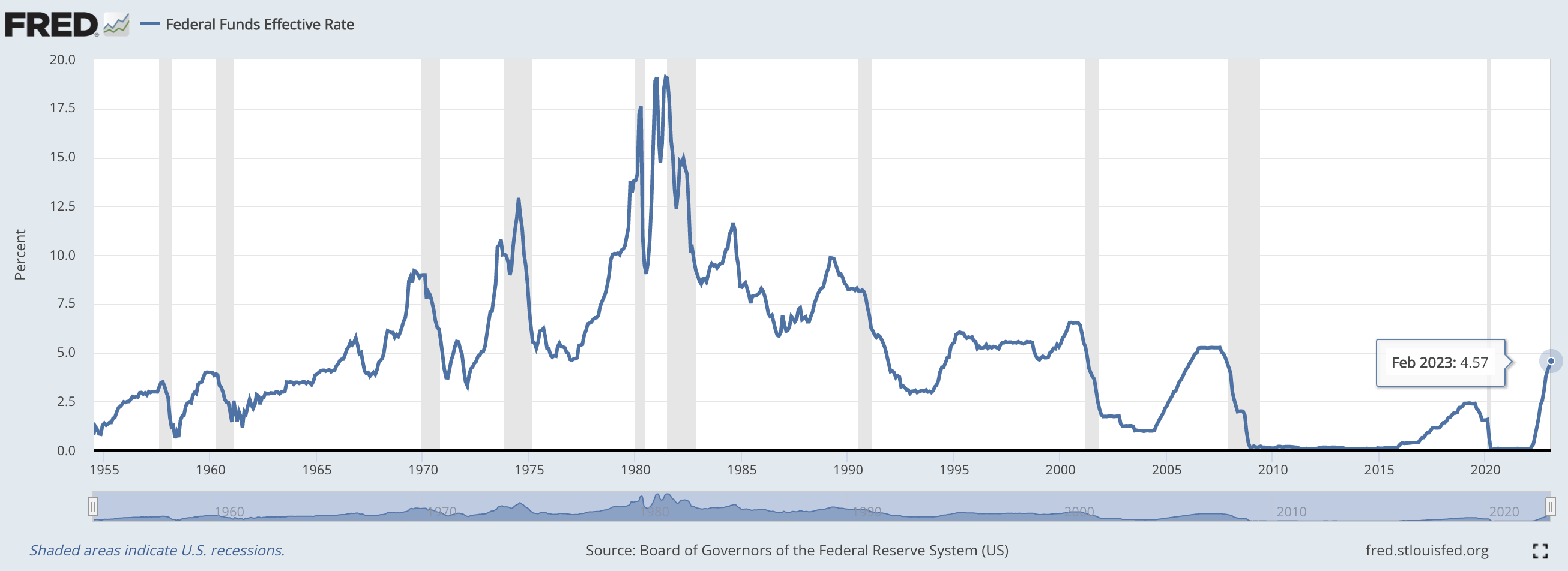

Federal Funds Rate: Definition and Use

Set by the Federal Open Market Committee (FOMC), the federal funds rate directly controls whether banks will lend any excess reserves to meet federal requirements. This rate has a huge impact on inflation, short-term borrowing and even investing. In this… read more…

How Much Does It Cost to Set Up a Trust?

A living trust is an estate planning vehicle that protects your assets against taxes and probate after you die. There are multiple types of trusts, like marital, bypass, generation-skipping and more. You can generally assign beneficiaries and make adjustments, unless your… read more…

Can You Collect Social Security and Disability?

Wondering whether you can collect Social Security and Social Security Disability Insurance (SSDI) at the same time? The short answer is probably not. The long answer, however, is maybe. Social Security and SSDI serve similar purposes, but the requirements vary for each. Social Security is for those who’ve reached early or full retirement age, while… read more…

What Is a Lump Sum Payment?

If you’ve got a pension plan, such as a 401(k) or an IRA, and you’d like to access the vehicle’s funds, you can typically choose between monthly distributions, a lump sum payment or an annuity. The method you select should consider… read more…

What Is Purchase APR?

Credit card issuers can charge you additional interest for making purchases while carrying balances on your credit card. This fee is known as purchase annual percentage rate, and it varies depending on your provider. In this guide, we tell you everything you need to know about purchase APRs. A financial advisor can help you manage… read more…

The Basics of Medicare Eligibility

Medicare is a federal health insurance program widely used by U.S. citizens and permanent residents age 65 and older. The program also applies to those younger than age 65 who have disabilities, end-stage renal disease (ESRD) or other diseases. But… read more…

What Is an Independent Contractor?

Independent contractors are professionals hired by individuals (or companies) to perform a service. Each one has different classifications under the IRS, which also means different tax obligations. However, it can sometimes be difficult to make the distinction between an independent contractor… read more…

What Are the Stock Market Holidays?

Several reasons play a role in when and why the New York Stock Exchange (NYSE) might temporarily close its markets, but the primary “culprit” behind the closings is national holidays. There are 10 main holidays on which NYSE closes its… read more…

5 States With No Sales Tax

Just as there are several states with no income taxes, there are also multiple states forgoing sales taxes. These states don’t impose state-level sales taxes, meaning you won’t be assessed an additional fee when purchasing a retail good or service.… read more…

Can Your Social Security Benefits Be Garnished?

Social Security benefits can be garnished depending on the type of payments and debt you owe. These deductions are usually carried out for financial liabilities such as back taxes, student loans, child support payments and more. But there are limitations… read more…

What Is a Regressive Tax System?

If you’re paying less in taxes as your taxable income increases, you’re likely following a regressive tax system. Regressive taxes offer an inverse relationship between income levels and tax rates; that is, a lower income will typically earn you a… read more…

Small Business Investment Company (SBIC): Definition and Usage

Small business investment companies (SBICs) are Small Business Administration-licensed and regulated companies that provide funding to small businesses in certain sectors. These companies rely on both internal funds and government funds to invest in small businesses, but they have to follow several regulations in order to maintain their SBA status. What is a Small Business… read more…

What Is a Progressive Tax System?

The idea of a progressive tax system helps ensure that there is some standard equity in the taxes that individuals with various levels of income incur. At its core, this means you’ll pay more in taxes as your taxable income… read more…

How Long Does the Underwriting Process Take?

If you’re planning on financing a home through a mortgage, you’ll have to go through the underwriting process. The underwriting process helps mortgage lenders and loan officers review your credit and financial history before approving you for financing. But for mortgages, the length of the process varies depending on multiple factors. In this guide, we explore… read more…

When Is Open Enrollment for 2023?

Open enrollment represents the yearly period where employees enroll in employer-sponsored insurance and healthcare plans. During this period, employees typically have the power to select new coverage, change their current benefit and coverage elections or maintain the same coverage they… read more…

Operating Income: Definition & Calculation

Operating income is a value that is used to demonstrate a company’s profitability after it has deducted other costs such as cost of goods sold (COGS), employee wages and other operating expenses. This measurement also excludes both taxes and non-operating… read more…

What Is Per Diem, and How Is It Taxed?

If you’re traveling for business reasons, you’ll probably incur lodging, meal and incidental expenses. This is where per diem payments come in. Your employer provides these as reimbursement for such expenses, and the payments usually aren’t taxable. But the rate… read more…

What Does a Cosigner Do?

If you meet a lender’s credit and income requirements, you’ll normally have free rein to take out loans on your own. But in circumstances where your credit levels aren’t high enough, or if you have no credit history at all,… read more…

Is Child Support Taxable Income?

Any child support payments you’ve received won’t be counted as taxable income. And if you’re the one making the child support payments, the income you used to do so won’t be tax-deductible. But there are ways to save on taxes… read more…

Car Insurance Discounts During the Coronavirus Crisis

Several insurance companies have created relief programs to support their car insurance customers during the COVID-19 pandemic. Most of these insurers are providing premium refunds, pausing policy cancellations, extending payment deadlines and more. And if you have an auto insurance policy in effect between April and May, you’ll probably qualify. However, while you’ll want to… read more…