The number of women-owned businesses in the U.S. has increased in recent years, which could be encouraging news for other women who are still building up the resources to start new ventures. According to data from the Census Bureau’s 2016 Annual Survey of Entrepreneurs, there were more than 1.1 million women-owned businesses in the 50 largest metro areas in 2016, up 2.8% from the year prior. However, as a percentage of total businesses, the representation of female-owned businesses remains low. In 2016, women owned only 20% of all employer businesses nationwide. Given that low percentage of women-owned businesses, SmartAsset looked at some of the best places for female entrepreneurs in this study in order to determine where women-owned businesses may be more likely to survive and grow.

To find the best places in the U.S. for women entrepreneurs, we used data from the Census Bureau’s Annual Survey of Entrepreneurs and 1-year American Community Survey. We considered eight factors that may influence a woman’s success in starting a new business. For more information on our data sources and how we created the final rankings, check out our Data and Methodology section below.

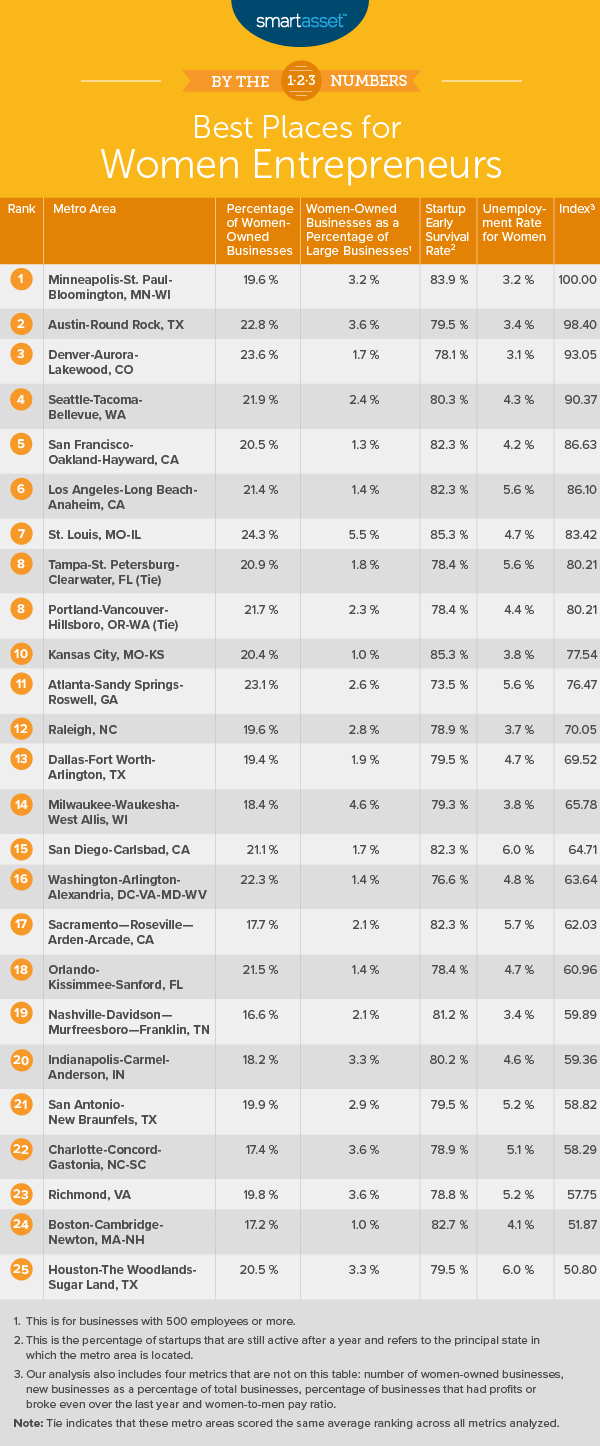

Key Findings

- The West Coast is conducive to female entrepreneurship. Four of the metro areas in our top 10 places for women entrepreneurs are on the West Coast. They are Seattle-Tacoma-Bellevue, San Francisco-Oakland-Hayward, Los Angeles-Long Beach-Anaheim and Portland-Vancouver-Hillsboro.

- Large businesses are predominantly owned by men. Though percentages of women-owned businesses in most metro areas are close to the national average of 20%, they significantly drop when considering only businesses with 500 or more employees. Though only 7.07% of businesses with at least 500 employees are owned by women in New Orleans-Metairie, Louisiana, this is the highest percentage for this metric across all metro areas we studied.

1. Minneapolis-St. Paul-Bloomington, MN-WI

The Minneapolis metro area has a favorable environment for women looking to start a business. Close to 85% of businesses had profits or broke even in 2016, and according to the Kauffman Indicators of Entrepreneurship report, 83.9% of startups are still active after one year in the state of Minnesota. Both of these are top-three rates. Additionally, women-owned businesses are already prominent in this metro area, meaning that women looking to start a business will have other women entrepreneurs in their community. Data from 2016 shows that of the total 72,274 employer businesses located in the Minneapolis metro area, 14,132 were women-owned, the 14th-highest number for this metric of all 50 metro areas for which we considered data. Those looking to work at startups can also benefit here, as Minneapolis ranks seventh in our study on the best cities for young professionals.

2. Austin-Round Rock, TX

Both new businesses and women-owned businesses are common in the Austin metro area. In 2016, 6.05% of businesses were formed within the previous three years, and 22.75% of businesses were owned by women. Compared to the other metro areas in our study, Austin-Round Rock ranks fifth and sixth, respectively, on those two metrics. The high percentages of both new businesses and women-owned businesses are promising indicators for female entrepreneurs. The workforce at women-owned startups can also take advantage of the fact that Austin ranks No. 2 in our study on the best cites for renters.

3. Denver-Aurora-Lakewood, CO

The Denver metro area had the lowest unemployment rate for women of any metro area in 2017, at 3.1%. And for those who aren’t satisfied pursuing the fast-growing jobs for women as mere employees, the Denver metro has high percentages of new and women-owned businesses, suggesting an encouraging environment for female entrepreneurs. Almost 6% of businesses in 2016 were formed within the previous three years, and 23.56% of businesses were owned by women.

Although 23.56% of businesses were women-owned in 2016, that number drops significantly when we consider only businesses with 500 or more employees. The Annual Survey of Entrepreneurs reports that only 1.67% of Denver-area businesses with more than 500 employees were female-owned in 2016, suggesting that women may have more difficulty in scaling their businesses there than in the other largest metro areas.

4. Seattle-Tacoma-Bellevue, WA

The Seattle metro area ranks in the top half of the study for seven of the eight metrics we considered. In particular, the gross number of women-owned businesses and the percentage of women-owned businesses of total businesses rank well here. In 2016, there were 17,620 women-owned businesses in the Seattle metro area, the 11th-highest number overall, and 21.92% of all businesses were women owned, the ninth-highest percentage overall. Seattle also ranks fourth in our study on cities where women are most successful.

5. San Francisco-Oakland-Hayward, CA

The San Francisco metro area performs well on the two employment figures specific to women that we considered, ranking 14th overall for both the metrics of women-to-men pay ratio as well as unemployment rate. In 2017, 4.2% of women were unemployed and median earnings for women workers in the metro area were 76.21% of men’s earnings. Relatively low unemployment rates for women and relatively high wages compared to men suggest that women may have more potential opportunity to save the income needed to dedicate towards starting their own businesses in the future.

6. Los Angeles-Long Beach-Anaheim, CA

Nearly 64,000 businesses in the Los Angeles metro area in 2016 were women-owned, the second-highest number for this metric of any metro area. This metro also has more equitable pay between women and men than many other metro areas. In 2017, the women-to-men pay ratio was 78.78%, the eighth-highest rate for this metric across the 50 metro areas for which we considered data.

7. St. Louis, MO-IL

In 2016, St. Louis, Missouri-Illinois had 24.34% of businesses that were women-owned, which is the highest percentage for this metric in the study and more than 4% higher than the national average. Moreover, women-owned businesses in St. Louis seem to be able scale better than those in many other metro areas. Approximately 5.47% of businesses with at least 500 employees were owned by women in 2016, the second-highest percentage of any of the 50 metro areas we considered, following only New Orleans-Metairie, Louisiana.

St. Louis does not perform as well for our two metrics concerned with women entrepreneurship: women-to-men pay ratio and the unemployment rate for women. According to 2017 Census estimates, women made almost 31% less than men on average, and 4.7% of women were unemployed.

8. Tampa-St. Petersburg-Clearwater, FL (tie)

In contrast to St. Louis, the Tampa metro area had the closest average earnings between women and men in 2017 of any metro area we considered. On average, annual earnings for women were about 83% of men’s, suggesting women may have a better chance at saving up to own a business.

8. Portland-Vancouver-Hillsboro, OR-WA (tie)

More than 85% of businesses in the Portland, Oregon metro area broke even or were profitable, the highest percentage for this metric across all 50 metro areas in our study. Additionally, new businesses and women-owned businesses are relatively common in this metro: Almost 6% of businesses were new, and 21.69% were women-owned in 2016.

10. Kansas City, MO-KS

Ranking first in our study on the best places for new businesses and seventh in our study on the best cities for women in tech, the Kansas City metro area rounds out our list as one of the best places for female entrepreneurs. Startup survival rates in the state of Kansas are high. According to a report from the Kauffman Indicators of Entrepreneurship, 85.32% of startups are still active after one year. Additionally, businesses are generally profitable, given that more than 83% of Kansas City businesses had profits or broke even in 2016.

Data and Methodology

To find the best places for female entrepreneurs, we analyzed data for the 50 largest metro areas across the following eight metrics:

- Number of women-owned businesses. Data is for businesses with paid employees and comes from the Census Bureau’s 2016 Annual Survey of Entrepreneurs.

- Percentage of women-owned businesses. Data is for businesses with paid employees and comes from the Census Bureau’s 2016 Annual Survey of Entrepreneurs.

- Percentage of businesses with at least 500 paid employees that are women owned. Data comes from the Census Bureau’s 2016 Annual Survey of Entrepreneurs.

- New businesses as a percentage of total businesses. This includes businesses established in 2014, 2015 and 2016 as a percentage of all businesses. Data is for businesses with paid employees and comes from the Census Bureau’s 2016 Annual Survey of Entrepreneurs.

- Percentage of all businesses that had profits or broke even. Data is for businesses with paid employees and comes from the Census Bureau’s 2016 Annual Survey of Entrepreneurs.

- Startup early survival rate (by state). This is the percentage of startups that are still active after one year. Data comes from the Kauffman Indicators of Entrepreneurship report and is for 2017.

- Women-to-men pay ratio. Data comes from the Census Bureau’s 1-year American Community Survey and is for 2017. It accounts for both part-time and full-time workers.

- Unemployment rate for women. Data comes from the Census Bureau’s 1-year American Community Survey and is for 2017.

First, we ranked each metro area in every metric, giving all metrics an equal weighting. We then found each area’s average ranking and used the average to determine a final score. The metro area with the best average ranking received a score of 100. The metro area with the lowest average ranking received a score of 0.

Tips for Managing Your Savings

- Invest early. An early retirement requires early planning. By planning and saving early you can take advantage of compound interest. Take a look at our investment calculator to see how your investment can grow over time.

- Trusted personal finance advice. A financial advisor can help you make smarter financial decisions such as moving or being in better control of your money as you navigate starting a new business or taking out an additional loan. Finding the right financial advisor who fits your needs doesn’t have to be hard. SmartAsset’s free tool matches you with financial advisors in your area in just five minutes. If you’re ready to be matched with local advisors that will help you achieve your financial goals, get started now.

Questions about our study? Contact us at press@smartasset.com

Photo credit: ©iStock.com/svetikd