The median household income in the U.S. was $61,937 in 2018, according to Census Bureau data. But what kind of life that income affords you depends on many factors, including your spending and saving habits as well as the cost of living in the place you call home. With that in mind, SmartAsset decided to find the best cities in the country to live on an income of $60,000.

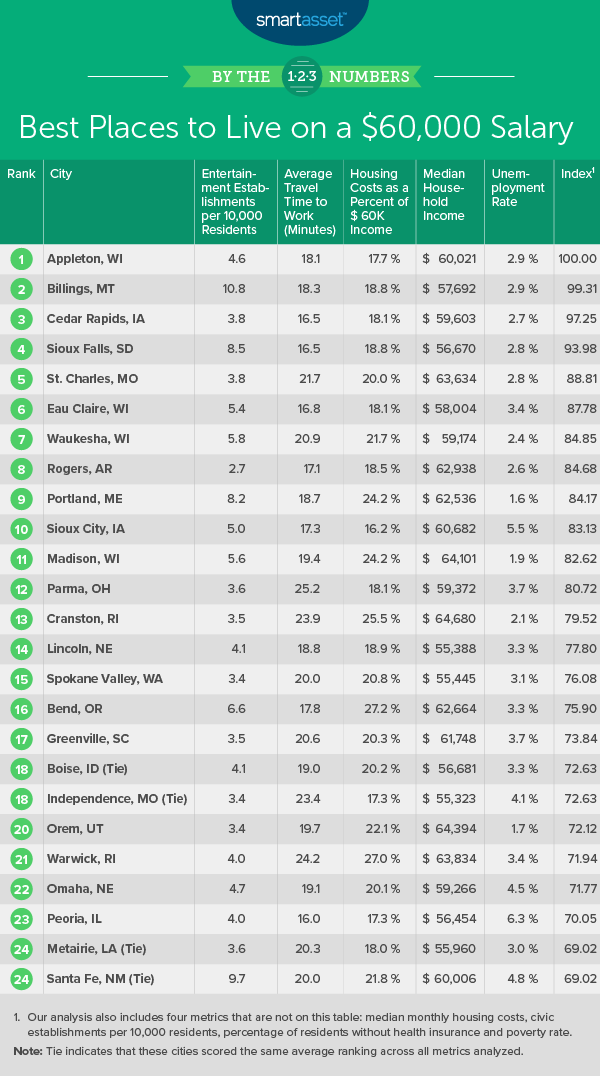

To find the best places in the U.S. to live on a $60,000 salary, we analyzed data for 109 cities across nine metrics: median household income, median monthly housing costs, housing costs as a percentage of income, entertainment and civic establishments per 10,000 residents, percentage of people without health insurance, average commute time, unemployment rate and the poverty rate. For details on our data sources and how we put all the information together to create our final rankings, check out the Data and Methodology section below.

Key Findings

- Households earning $60,000 are unlikely to be housing cost-burdened. A family earning $60,000 should be able to comfortably afford housing costs in cities where the median household income ranges from $55,000 to $65,000. Median housing costs make up less than 24% of a $60,000 income, on average, across all 109 cities in our study. That is lower than the threshold of 30% which the Department of Housing and Urban Development defines as housing cost-burdened.

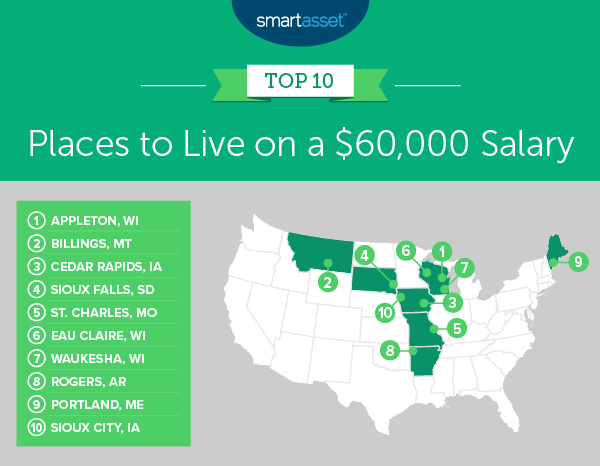

- Midwestern cities rank on top. There are seven Midwestern cities in our top 10, representing Iowa, Missouri, South Dakota and Wisconsin. Wisconsin is home to three of those cities – Appleton, Eau Claire and Waukesha.

1. Appleton, WI

Appleton, Wisconsin places fourth in terms of poverty rate, coming in at 7.2%. It also has the sixth-lowest median monthly housing costs, at $887 per month, and ranks sixth-lowest for housing costs as a percentage of a $60,000 income, at 17.74%. Appleton ranks 10th for average commute time, at 18.1 minutes.

2. Billings, MT

Billings, Montana has the ninth-lowest percentage in the study of residents without health insurance: Only 4.4% of the people in Billings are not covered by health insurance. The city ranks 11th for both its low average commute time, at 18.3 minutes, and low unemployment rate, at 2.9%. Billings ranks 12th most affordable for both the median monthly housing costs and housing costs as a percentage of a $60,000 income, at $939 and 18.78%, respectively.

3. Cedar Rapids, IA

Cedar Rapids, Iowa is tied for the third-lowest average commute time in this study, at just 16.5 minutes. It also places in the top 10 for four other metrics: percentage of residents without health insurance, at only 4.3%; unemployment rate, at 2.7%; median monthly housing costs, at $904 and housing costs as a percentage of a $60,000 income, at 18.08%.

4. Sioux Falls, SD

Sioux Falls, South Dakota is tied for the third-lowest average commute time on this list, at 16.5 minutes. It is also tied for the ninth-lowest unemployment rate in the study, at 2.8%, and finishes in the top 15 for affordability in the housing-related metrics, with median monthly housing costs at $939 and housing costs at 18.78% of a $60,000 income.

5. St. Charles, MO

St. Charles, Missouri is tied for the sixth-lowest percentage of residents without health insurance in this study, at 4.3%. It is also tied for the ninth-lowest unemployment rate, at 2.8%, and has the seventh-lowest poverty rate, at 8%. St. Charles has the 11th-highest median household income in the study, at $63,634. It ranks 20th for both its median monthly housing costs, at $1,002, as well as housing costs as a percentage of a $60,000 income, at 20.04%.

6. Eau Claire, WI

Eau Claire, Wisconsin is the second city in the Badger State to make the list. It ranks sixth for average commute time, at 16.8 minutes, and it comes in 10th for both median monthly housing costs as well as for housing costs as a percentage of a $60,000 income. The average monthly housing costs in Eau Claire are $907, which represents 18.14% of a $60,000 income. On the downside, Eau Claire does finish in the bottom half of the study for median household income, at $58,004.

7. Waukesha, WI

The final Wisconsin city in our top 10 is Waukesha, which ranks sixth best overall in terms of unemployment rate, at 2.4%. It ranks within the top half of the study for its low poverty rate, at 13%, and ranks 30th overall for both housing metrics. Median monthly housing costs in Waukesha are $1,083, which is 21.66% of a $60,000 income. Waukesha finishes in the top 30 for both entertainment establishments and civil establishments per 10,000 residents, at approximately six and 10, respectively.

8. Rogers, AR

Rogers, Arkansas finishes 11th for affordability in the housing metrics in this study: The median monthly housing costs in Rogers are $924, which is 18.48% of a $60,000 income. The city has the seventh-shortest average commute time in the study, at 17.1 minutes, and the seventh-lowest unemployment rate, at 2.6%. The poverty rate in Rogers is 8.2%, the ninth-lowest rate for this metric in the study.

9. Portland, ME

Portland, Maine has the lowest unemployment rate in the study, at 1.6%. It doesn’t fare as well in terms of housing, with median housing costs of $1,209 per month, which is 24.18% of a $60,000 income. The city comes in fifth for its number of civic establishments, at approximately 14 per 10,000 residents. The average commute time in Portland is roughly 18 minutes and ranks 12th-fastest overall.

10. Sioux City, IA

Sioux City, Iowa has the lowest median monthly housing costs and the lowest housing costs as a percentage of income across all 109 cities for which we considered data. The median monthly housing costs there are $808, which is 16.16% of a $60,000 income. Sioux City also finishes in the top 10 for civic institutions per 10,000 residents, at almost 13. It also has the eighth-shortest average commute overall study, at approximately 17 minutes.

Data and Methodology

To find the best cities in the U.S. to live on a $60,000 salary, SmartAsset first created a list of the cities in which the median household income was between $55,000 and $65,000. We did this in order to find the cities where an income of $60,000 fell within the range of an average household. This resulted in a list of 109 cities, which we compared across the following nine metrics:

- Median household income. Data comes from the Census Bureau’s 2018 1-year American Community Survey.

- Median monthly housing costs. Data comes from the Census Bureau’s 2018 1-year American Community Survey.

- Housing cost as a percentage of income. We calculated this by finding the median monthly housing costs as a percent of a $60,000 salary. Data comes from the Census Bureau’s 2018 1-year American Community Survey.

- Entertainment establishments per 10,000 residents. Data comes from the Census Bureau’s 2016 Business Patterns Survey. It is measured at the county level.

- Civic establishments per 10,000 residents. Data comes from the Census Bureau’s 2016 Business Patterns Survey. It is measured at the county level.

- Percentage of people without health insurance. Data comes from the Census Bureau’s 2018 1-year American Community Survey.

- Average commute time. Data comes from the Census Bureau’s 2018 1-year American Community Survey.

- Unemployment rate. Data comes from the Census Bureau’s 2018 1-year American Community Survey.

- Poverty rate. Data comes from the Census Bureau’s 2018 1-year American Community Survey.

First, we ranked each city in each metric. From there, we figured out the average ranking for each city, giving each metric equal weight. Using this average ranking, we created our final score. The city with the highest average ranking received a score of 100, and the city with the lowest average score received a 0.

Tips for Managing Your Money

- Have a smart plan for your salary. A financial advisor can help you get the most out of your money, regardless of your salary. And finding the right financial advisor doesn’t have to be hard. SmartAsset’s free tool matches you with financial advisors in your area in 5 minutes. If you’re ready to be matched with local advisors that will help you achieve your financial goals, get started now.

- How much are you really taking home? Your take-home pay is different from your salary, of course. See what you’ll actually be putting in the bank each week with our paycheck calculator.

Photo credit: ©iStock.com/PeopleImages