Bills pile up and debt accumulates, causing the pressure of financial concerns to grow. While there are certainly ways to get out ahead of these struggles – saving carefully, using a budget or making smart investments – sometimes things happen that make financial stress inevitable, even for the most careful planners. Some cities, though, are more financially stressed than others, so SmartAsset analyzed data to find which cities in America have the most financial stress.

We analyzed 90 cities across the following eight metrics: unemployment rate, average mortgage as a percentage of median home value, percentage of population living below poverty level, percentage of households who are severely housing-cost burdened, average debt, percentage of people who reported that they didn’t see a doctor due to cost, change in income and the divorce rate. For details on our data sources and how we put all the information together to create our final rankings, check out the Data and Methodology section below.

Key Findings

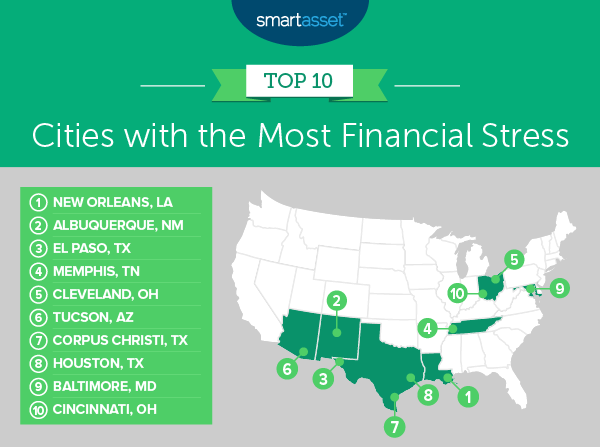

- It’s tough in Texas. Three of the top 10 cities and six of the top 25 cities with the most financial stress are in the Lone Star State.

- Housing problems. In 15 of the 90 cities in our study, state-level data shows that the average mortgage value exceeds the median home value. In 40 of the 90 cities we looked at, more than 10% of residents are spending 50% or more of their income on housing costs.

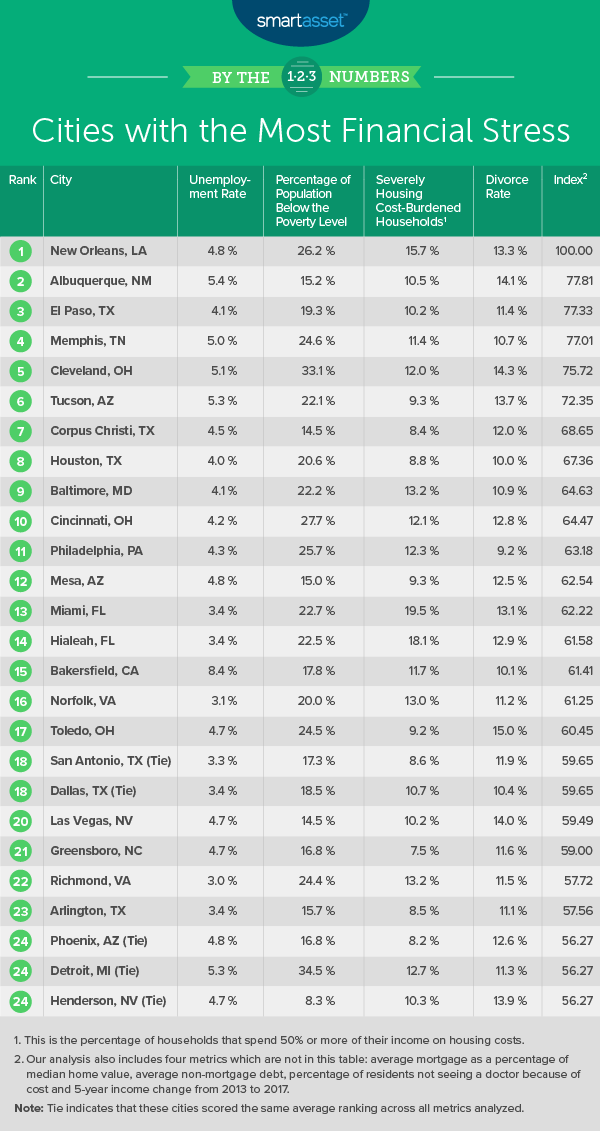

1. New Orleans, LA

The most financially-stressed city in the country is New Orleans, Louisiana. The Big Easy saw income growth of just 1% in the five-year period from 2013 and 2017, the fourth-lowest change in our study. Around 26.2% of the population is living below the poverty line, the fifth-highest rate for this metric across all 90 cities we studied. The unemployment rate in New Orleans is 4.8%. Additionally, 15.7% of households are severely housing cost-burdened. That is the eighth-highest rate of cost-burden in the study. On a state level, more than 17% of Louisiana’s population reported not seeing a doctor due to cost, according to Kaiser Family Foundation data.

2. Albuquerque, NM

Albuquerque, New Mexico is the second-most financially stressed city in our study. It has the fifth-highest unemployment rate overall, at 5.4%. The divorce rate, at 14.1%, is the eighth-highest in the study. Albuquerque also has the sixth-slowest income growth in the study over the five-year period from 2013 to 2017, at 4.3%. About 15.2% of Albuquerque’s population lives below the poverty level.

3. El Paso, TX

El Paso is the first of three cities from Texas in our top 10. The average mortgage in the state is 101.2% of the average home value, the highest percentage of any state with a city on this list. The average total debt in Texas is approximately $26,322, a top-20 rate. Income increased 8.8% in El Paso in the five-year period from 2013 through 2017, the 13th-slowest growth in the study. On a state level, more than 19% of Texas’ population – the highest rate across all states we considered in this study – reported not seeing a doctor due to cost, according to Kaiser Family Foundation data.

4. Memphis, TN

Memphis, Tennessee ranks eighth in two of the metrics we analyzed – the percentage of the population living below poverty level, at 24.6%, as well as income change over the five-year period from 2013 through 2017, at 7.1%. Memphis has the 10th-highest unemployment rate of any city in our study, at 5%. It also ranks just outside of the top 25 for its high mortgage as a percentage of median home value, at 93.8%.

5. Cleveland, OH

The fifth city on our list is Cleveland, Ohio, where 33.1% of the population lives below poverty level. This is the second-highest rate for this metric of all 90 cities we considered in this study. Cleveland has a divorce rate of 14.3%, the seventh-highest rate in the study. Average income grew by 11% from 2013 through 2017, the 18th-lowest rate for this metric overall.

6. Tucson, AZ

Tucson, Arizona’s unemployment rate of 5.3% is the sixth highest in this study and the second-highest in our top 10. It ranks 12th for divorce rate, at 13.7%. Around 22.1% of the population is living below the poverty line. That’s the 15th-highest rate for this metric of all the cities we studied. On a state level, average debt in Arizona is $25,670. Furthermore, more than 14% of Arizona’s population reported not seeing a doctor due to cost, according to Kaiser Family Foundation data.

7. Corpus Christi, TX

The second Texas location in our top 10, and ranking seventh overall, is Corpus Christi. Like in the other Texas cities on this list, it has a high average mortgage as a percentage of median home value, at 101.2%. The average debt in the state is $26,322. The unemployment rate in Corpus Christi is 4.5%, one of the 30 highest rates in this study overall.

8. Houston, TX

Houston, Texas has a high average mortgage as a percentage of median home value, at 101.2%. Additionally, according to Kaiser Family Foundation data, the state of Texas has a high percentage of its population reporting that they hadn’t seen a doctor because of cost, at 19.6%. Houston has an unemployment rate of 4%. More than 22% of its population lives below poverty level, and almost 9% of the population is severely housing cost-burdened, meaning that they are spending at least 50% of their household income on housing costs.

9. Baltimore, MD

Baltimore, Maryland ranks as the ninth city on our list of cities with the most financial stress. Maryland has a statewide average debt level of approximately $27,866, which is the third-highest average debt amount in our study. Baltimore comes in 14th-highest overall for the percentage of the population living below the poverty line, at 22.2%, as well as 14th-highest overall for the percentage of households in the city who are severely housing cost-burdened, at 13.2%.

10. Cincinnati, OH

The 10th city in our study on the cities with the most financial stress is Cincinnati, Ohio. This is the second Ohio city, along with Cleveland, to fall in the top 10. Around 27.7% of the population is living below the poverty line, the fourth-highest percentage on this list. Approximately 12.1% of Cincinnati’s households are severely housing cost-burdened. As far as statewide metrics go, approximately 11.3% of Ohio’s population reported that they did not see a doctor because of cost, and average debt in the state is upwards of $24,500.

Data and Methodology

To find the cities in America with the most financial stress, SmartAsset analyzed 90 cities across the following eight metrics:

- Unemployment rate. Data comes from the Bureau of Labor Statistics and is for July 2019.

- Average mortgage as a percentage of median home value (by state). Data comes from the Census Bureau’s 2017 1-year American Community Survey and the Experian State of Credit Q2 2018 study.

- Percentage of population below poverty level. Data comes from the Census Bureau’s 2017 1-year American Community Survey.

- Percentage of severely housing cost-burdened households. Data comes from the Census Bureau’s 2017 1-year American Community Survey. This is the percentage of households that spent 50% or more of their income on housing costs.

- Average debt (by state). Data comes from the Experian State of Credit Q2 2018 study.

- Percentage of people reporting not seeing a doctor due to cost (by state). Data comes from the Henry J. Kaiser Family Foundation and is for 2017.

- Income change. Data comes from the Census Bureau’s 2013 and 2017 1-year American Community Surveys.

- Divorce rate. Data comes from the Census Bureau’s 2017 1-year American Community Survey.

First, we ranked each city in each metric. From there, we figured out the average ranking of each city. Each metric received an equal weight except for unemployment rate and percentage of households who are severely housing-cost burdened, which each received a double weight. We used this average ranking to create the final scores. The city with the highest average ranking received a score of 100, and the city with the lowest average ranking received a score of 0.

Tips on Managing Your Money

- Reduce anxiety with advice. If you are feeling stressed financially, a financial advisor may be able to help. SmartAsset’s free tool matches you with financial advisors in your area in 5 minutes. If you’re ready to be matched with local advisors that will help you achieve your financial goals, get started now.

- How much house can I afford? Buying a home can add significantly to financial stress if it isn’t done correctly. Use SmartAsset’s tool to see just how much house you can afford.

Questions about our study? Contact press@smartasset.com

Photo credit: ©iStock.com/fizkes