With many small businesses struggling to maintain their financial reserves during COVID-19, Bank of America, JPMorgan Chase and Wells Fargo were the U.S. lenders that originated the highest number of Paycheck Protection Program (PPP) loans. Between the first week of April and the end of June 2020, the three banks originated more than 789,600 PPP loans of the total 4.8 million that were distributed. Bank of America took the lead, originating almost 334,700 PPP loans in that time, or roughly 7% of the total number apportioned. Though those banks were the most popular according to the number of PPP loans originated nationally, other lenders took the top spot in different states around the country.

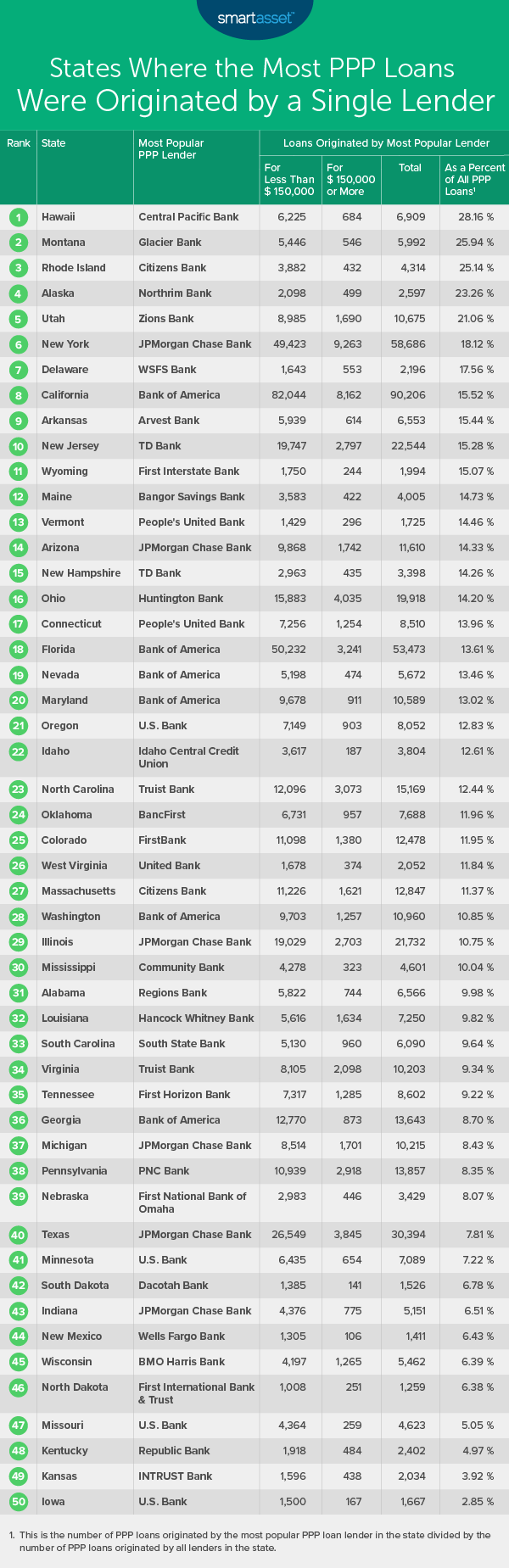

Using data published by the Small Business Administration (SBA) in coordination with the Treasury Department, SmartAsset identified the most popular PPP loan lender in each state. From there, we determined the states where the highest number of PPP loans were originated by a single lender, i.e. where the most popular PPP lender made up the largest percentage of total loans originated. For details on our data sources and how we put all the information together to create our final rankings, check out the Data and Methodology section below.

Key Findings

- One credit union made the bank-dominated list. The Coronavirus Aid, Relief and Economic Security (CARES) Act, which included the PPP, allowed a wide range of lenders – including traditional SBA lenders, banks, credit unions and fintech lenders – to make the loans. Despite this range of possibilities, the most popular PPP lender in 49 of the 50 states was, perhaps expectedly, a bank. Idaho is the only state where a credit union – specifically, Idaho Central Credit Union – was the most popular PPP loan lender.

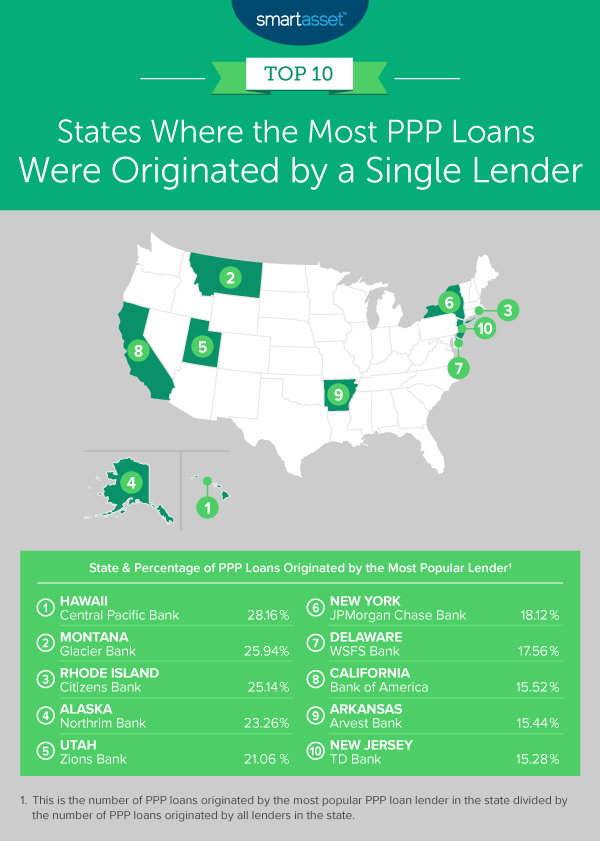

- A single lender originated more than a fourth of loans in three states. Central Pacific Bank in Hawaii, Glacier Bank in Montana and Citizens Bank in Rhode Island originated more than 25% of PPP loans to small businesses in their respective states.

- There was a variety of the most popular PPP loan lenders across all 50 states. There are 33 unique most popular lenders in our study. Only seven lenders were the most popular in two or more states. They are JPMorgan Chase, Bank of America, U.S. Bank, Citizens Bank, TD Bank, People’s United Bank and Truist Bank. JPMorgan Chase and Bank of America were both the most popular PPP loan lender in six states.

1. Hawaii – Central Pacific Bank

According to data on the number of loans originated, Central Pacific Bank was the most popular PPP lender in Hawaii. Between the first week of April and the end of June, Central Pacific Bank originated roughly 6,900 PPP loans made to businesses. Of those, about 6,200 were loans of less than $150,000, while the remaining roughly 700 were loans of $150,000 and more. In total, Central Pacific Bank originated more than 28% of the PPP loans dispersed in Hawaii.

2. Montana – Glacier Bank

Almost 26% of PPP loans in Montana were originated by Glacier Bank, headquartered in Kalispell, Montana. Specifically, of the roughly 23,100 PPP loans allotted to small businesses in the state, Glacier Bank originated close to 6,000.

3. Rhode Island – Citizens Bank

About 200 lenders in Rhode Island participated in PPP loan distribution. Citizens Bank was the most popular PPP loan lender of that total, despite only accepting applications from existing customers. Citizens Bank originated more than 4,300 PPP loans between the first week of April and the end of June.

4. Alaska – Northrim Bank

Like in Rhode Island, about 200 lenders in Alaska participated in the Paycheck Protection Program. Of those lenders, Northrim Bank was the most popular. Northrim Bank approved and originated a total of close to 2,600 PPP loans, the majority being for amounts of less than $150,000. Specifically, about 81% of Northrim Bank-originated PPP loans were for less than $150,000, while the remaining roughly 19% of them were for $150,000 or more.

5. Utah – Zions Bank

Though Zions Bank serves 10 states throughout the West and Southwest, it is headquartered in Utah. Accepting PPP loan applications from both existing and new customers, Zions Bank originated close to 10,700 loans from the time the program started in April through the end of June. This represents 21.06% of all PPP loans for small businesses in the state of Utah.

6. New York – JPMorgan Chase

Though there were close to 1,200 PPP loan lenders in New York State, more than 18% of all PPP loans in the state were originated by JPMorgan Chase Bank. The bank originated about 49,400 loans to businesses for less than $150,000 and almost 9,300 to businesses for $150,000 or more.

7. Delaware – WSFS Bank

Close to 18% of PPP loans distributed to businesses in the state of Delaware came from Wilmington Savings Fund Society Bank, otherwise known as WSFS Bank. WSFS Bank originated roughly 2,200 PPP loans between the beginning of April and the end of June. Only about 12,500 were originated in the state overall.

8. California – Bank of America

Across all 50 states, the highest number of PPP loans were originated in California. Between the first week of April and the end of June 2020, California lenders originated more than 581,100 PPP loans to small businesses. Of that total, more than 90,200 loans were originated by Bank of America.

Bank of America may be a good banking option for individuals as well as businesses. It ranks as one of our best banks in 2020.

9. Arkansas – Arvest Bank

Arvest Bank has a large presence in the states of Arkansas, Kansas, Missouri and Oklahoma. More than 15% of PPP loans given to Arkansas businesses were originated by Arvest Bank. About 91% of Arvest Bank’s PPP loans were for amounts of less than $150,000.

10. New Jersey – TD Bank

The most popular PPP loan lender in New Jersey was TD Bank. Over the first three months of the Paycheck Protection Program, TD Bank originated about 19,700 loans that were for less than $150,000 to small businesses and close to 2,800 PPP loans that were for $150,000 or more.

Data and Methodology

Data for this study comes from the Small Business Administration (SBA) and the Treasury Department. To find the most popular PPP loan lender in each state, we first totaled the number of PPP loans that each lender distributed between April 3, 2020 and June 30, 2020 and found the lender with the highest figure. From there, we determined the states where the highest number of PPP loans were originated by a single lender, ranking on this metric. To find that figure, we divided the number of number of PPP loans originated by the most popular PPP lender in the state by the number of PPP loans originated by all lenders in the state.

Small Business Tips During the COVID-19 Crisis

- Find support from other sources. Several other establishments are providing relief to individuals and businesses who’ve sustained financial loss because of coronavirus. See our full list of companies helping coronavirus-impacted people.

- Rethinking your retirement strategy? Are you considering – or reconsidering – how you want to save for retirement after the crisis? Use SmartAsset’s retirement calculator to see what steps you might take.

- Seek expert advice. If you are a business owner who is seeking guidance during the ongoing crisis, consider working with a financial advisor. SmartAsset’s free tool matches you with financial advisors in your area in five minutes. If you’re ready to be matched with local advisors that will help you achieve your financial goals, get started now.

Questions about our study? Contact us at press@smartasset.com

Photo credit: ©iStock.com/Kameleon007