Paying off a large amount of credit card debt can be challenging. It is especially difficult when you are saddled with high rent costs and bleak employment prospects like some millennials are. How much are these two factors affecting millennials’ ability to stay on top of debt? We looked at these and other metrics to find out where millennials are struggling with paying off their credit card debt.

Holding onto a lot of credit card debt? A balance transfer credit card could help you pay it off.

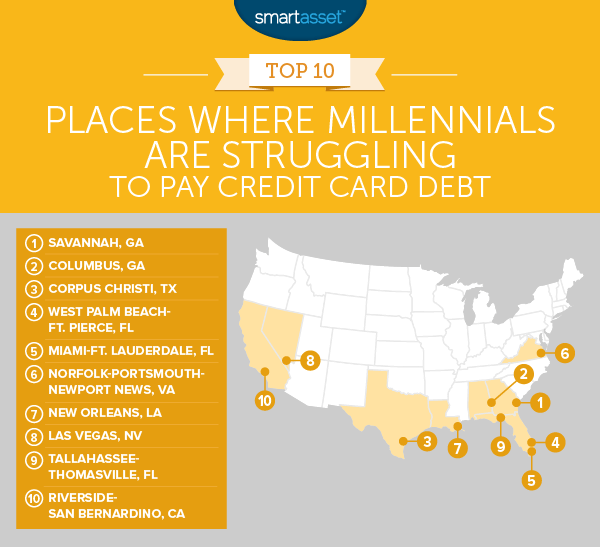

For the purposes of this study, we defined “millennials” as persons aged 20 – 34 in 2015. In order to find the places where millennials are struggling the most to pay off their credit card debt, we compared 202 metro areas. We compared them across metrics like the average credit score for millennials, average credit card debt for millennials, millennial unemployment rate, median gross rent for a one-bedroom apartment and median gross rent for a one-bedroom apartment as a percent of median individual income.

Key Findings

- Winning in Wisconsin – According to our data, millennials in Wisconsin are the best-positioned to pay off credit card debt. Three of the bottom five places on our list are in Wisconsin. They are Green Bay-Appleton, Wasau-Rhinelander and La Cross-Eau Claire. These metro areas have low unemployment rates and high average credit scores.

- Peach State struggles – Four of the top 20 places where millennials struggle to pay off their credit card debt are in Georgia. Georgia millennials are facing high unemployment rates and high amounts of average credit card debt.

1. Savannah, Georgia

The oldest city in Georgia takes the top spot for places where millennials struggle to pay their credit card debt. Millennials in Savannah, on average, have high credit card debt and high unemployment rates. This makes for a difficult situation where millennials may be without a steady income and simultaneously have large credit card bills to pay.

The real kicker though is median one-bedroom rent as a percent of median individual income. Our data shows it would cost 34% of the average resident’s income to pay for the average one-bedroom apartment. According to the Department of Housing and Urban Development, this makes the average Savannah resident housing cost-burdened. It also means Savannah millennials may have less cash to put toward paying down their credit card debt, after paying rent.

2. Columbus, Georgia

Columbus, Georgia millennials have one of the highest unemployment rates in our study. For millennials without a job, paying off credit card debt may be difficult.

Another obstacle facing Columbus millennials is the low average credit score. A low credit score typically means a higher APR on your credit card, which means higher interest payments on long-standing credit card debt. Our data shows that Columbus millennials have an average credit score of 603, which is considered fair.

3. Corpus Christi, Texas

When you have a lot of credit card debt and a low credit score, odds are your credit card bills include high interest costs. This is the situation facing Corpus Christi millennials. They have the ninth-lowest average credit score (593), which suggests they don’t have access to the best low APR credit cards. They also have the 15th-highest average credit card debt ($3,844).

Credit card payments aren’t the only factor putting a dent in Corpus Christi millennials’ budgets. Rent eats up a large chunk of the average resident’s budget. According to Census Bureau data, rent on the average one-bedroom apartment in the area is equal to 33% of the median income.

4. West Palm Beach-Fort Pierce, Florida

Millennials in the West Palm Beach-Fort Pierce area have relatively high credit scores – at least when compared to the rest of the top 10. Millennials there have an average credit score of 621. That’s the second-highest credit score in our top 10.

The main issue for millennials is the area’s high rents combined with large amount of credit card debt, on average. The average one-bedroom apartment in this area goes for $937 per month, which is the equivalent of just under 40% of the average resident’s annual income. If you are paying 40% of your income on rent, it may mean you cannot tackle high credit card debt aggressively enough.

5. Miami-Fort Lauderdale, Florida

Millennials in Miami-Fort Lauderdale struggle to pay their credit card debt for many of the same reasons their neighbors in West Palm Beach-Fort Pierce do. That is, high rents and high average credit card debt. Apart from those two factors, millennials in Miami-Fort Lauderdale also struggle with employment. According to U.S. Census Bureau data just over 9% of millennials in the area are unemployed. Without a steady income and faced with sky high rents, millennials here may find it challenging to pay off debt.

6. Norfolk-Portsmouth-Newport News, Virginia

With $4,303 in average credit card debt, Norfolk-Portsmouth-Newport News millennials have the second-most credit card debt in the study. Only Fairbanks, Alaska millennials have more debt ($4,925, on average).

Unfortunately, Norfolk-Portsmouth-Newport News millennials also have a fairly low average credit score, meaning they’re likely paying a high APR. As we explained previously, this can lead to a vicious cycle of racking up mounting debt due to high interest charges.

7. New Orleans, Louisiana

The Big Easy takes seventh for where millennials are struggling to pay their credit card debt. For starters rent in the area can be expensive. Our data shows that the average New Orleans resident would need to pay just over 30% of income to afford the average one-bedroom apartment in the area. On top of facing high housing costs, New Orleans millennials also tend to have a lot of credit card debt. The average millennial in New Orleans has over $3,600 in credit card debt.

8. Las Vegas, Nevada

The average millennial in Sin City has just under $3,700 in credit card debt. That’s the 22nd-highest rate in our study. Like millennials in other cities, Las Vegas millennials have mediocre credit scores. This can lead to a higher average APR, which in turn makes each monthly credit card bill more expensive and harder to pay.

9. Tallahassee-Thomasville, Florida

Tallahassee-Thomasville millennials have done a good job keeping their credit card debt relatively low. On average millennials here have just over $3,200 in credit card debt. That’s the second-lowest rate in the top 10.

The reasons millennials may struggle to pay off credit card debt is the local economic conditions in Tallahassee-Thomasville. Millennials face a 10.23% unemployment rate. Housing costs are also a drag on residents’ budgets. Our data shows that the average resident renting the average one-bedroom apartment would need to spend about 36% of income on rent. After paying for food and other necessities, that doesn’t leave a ton left over for paying credit card bills.

10. Riverside-San Bernardino, California

Living in southern California can be expensive. So, it’s somewhat surprising to see that Riverside-San Bernardino millennials have piled up the least amount of credit card debt in our top 10. However, outside of total credit card debt there’s not a ton for Riverside-San Bernardino millennials to smile about. On average millennials in the area have a credit score of just over 590. This means they are probably stuck paying high interest rates on their credit card debt. At the same time millennials here also have an unemployment rate over 12%.

Adding to the high unemployment and high interest rate woes, millennials in Riverside face budget-crippling housing costs. We estimate that the average one-bedroom apartment would consume over 37% of the average resident’s income.

Data and Methodology

In order to determine where millennials are struggling to pay credit card debt, we looked at data on 202 metro areas. Specifically, we looked at data on the following five factors:

- Average credit score for millennials. Data comes from Experian’s 2016 State of Credit Report.

- Average credit card debt for millennials. Data comes from Experian’s 2016 State of Credit Report.

- Millennial unemployment rate. This is the unemployment rate for persons aged 20 – 34. Data comes from the U.S. Census Bureau’s 1-Year American Community Survey.

- Median gross rent for a one-bedroom home. Data comes from the U.S. Census Bureau’s 1-Year American Community Survey.

- Median gross rent for a one-bedroom home as a percent of median individual income. Data on median rents comes from the U.S. Census Bureau’s 1-Year American Community Survey and data on median individual incomes comes from the U.S. Census Bureau’s 1-Year American Community Survey.

First we ranked each city across each factor, giving equal weighting to all factors. Then we found the average ranking for each city. We based our final score on each city’s average ranking. The city with the highest average ranking received a 100. The city with the lowest average ranking received a 0.

Tip for Paying off Credit Card Debt

If you have a large amount of credit card debt and are struggling to pay it off, you may want to consider using a balance transfer credit card. A balance transfer card allows you to transfer your existing credit card debt to another card. The reason this can be a good idea is that many cards will offer 0% APR over a set period of time, say 15 months. During this time you can work on tackling your credit card debt, without racking up additional interest.

Questions about our study? Contact us at press@smartasset.com.

Photo credit: ©iStock.com/antonioguillem