Relying too much on credit cards to make ends meet is a bad habit to get into. Credit cards typically come with high interest rates and harsh penalties for late payment fees, meaning even small amounts of credit card debt can spiral out of control. Some states do a better job of staying on top of their credit card debt than others. Below SmartAsset looks at credit card usage data to find the states with the worst credit card habits.

Check out the best rewards credit cards.

In order to find the states with the worst credit card habits we looked at data on credit card debt per capita, credit card debt as a percent of income, delinquency rate on credit card debt, late payment rate and credit utilization rate. Check out our data and methodology section below to see where we got our data and how we put it together.

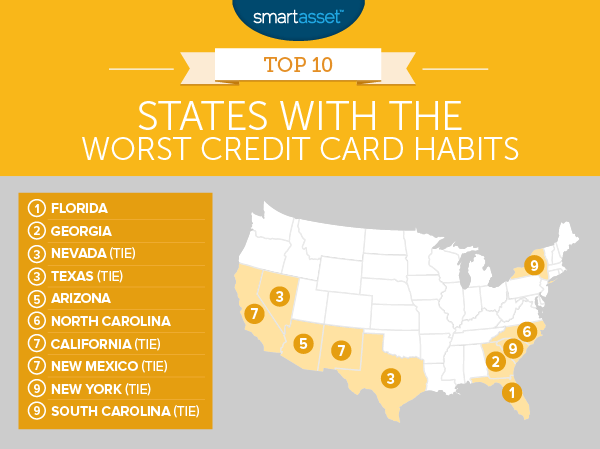

Key Findings

- Tardy South – Five of the states with the worst credit card habits are in the South. They are Florida, Georgia, Texas, North Carolina and South Carolina. A big reason these states rank so poorly is that residents tend to struggle with paying their credit card bills on time.

- Alaska toeing the line – Alaska leads the nation in both credit card debt per capita and credit card debt as a percent of income, yet it ranked only 12th in this study. How did it escape the top 10? Outside of being reliant on their credit cards, residents of Alaska do a good job at paying them off in a timely fashion. For example, only 5.4% of credit card debt in Alaska is greater than 90 days delinquent, on top of that only 0.28 late payments per billing cycle.

- Midwest is best – Several states in the Midwest are the most responsible credit card users, according to our study. Nine of the bottom 10 states in the study (i.e. the states with best credit card habits) are in the Midwest, including Iowa, Wisconsin, Nebraska, North Dakota, South Dakota and Minnesota.

1. Florida

According to our data, the Sunshine State is one of the most credit card debt-burdened in the country. On a per capita basis, Florida residents have $2,910 in credit card debt. While the state only ranks 14th for that metric, it becomes worse when income is taken into consideration. Florida ranks second in the nation for credit card debt as a percent of income. Credit card debt per capita equals 11.5% of median annual individual income in Florida. Florida residents also seem to be feeling the pressure of that mounting debt as they have the second-highest credit card delinquency rate in the country.

2. Georgia

Florida’s neighbor, Georgia, comes in second. Residents of the Peach State appear to be fond of using their credit cards. Our data tells us that on average Georgia residents have a credit card utilization of 34.8%. That’s the highest in the top 10 and second-highest in the nation. Georgia residents also seem to struggle to make their credit card payments on time. Our data shows us that the average resident makes about 0.6 late payments per billing cycle.

3. (tie) Nevada

Nevada leads the nation in its delinquency rate, with just under 11% of all credit card debt being more than 90 days delinquent. While putting off paying credit card debt may offer short-term reprieve to Nevada residents, not making those payments may hurt their credit scores in the long term. Current data shows that Nevada residents use about 32.7% of their credit limit on average.

3. (tie) Texas

They say everything is bigger in Texas. Except, perhaps, credit card debt. Texas residents hold $2,760 in credit card debt per capita. That translates to 10.1% of median annual income. If we only considered those two metrics, Texas would not be in the top 10. However residents in Texas have a tough time making payments on time. The Lone Star State ranks second for late payment rate, with the average resident making over 0.6 late payments per billing cycle.

5. Arizona

The Grand Canyon State ranks fifth in our study of the states with the worst credit card habits. For the average resident of Arizona to pay off his credit card debt in its entirety he would need to fork over 10.5% of his annual income. This may not be a bad strategy for some Arizona residents as it would allow them to lower their utilization rate. Our data shows that, on average, Arizona residents are using 31.2% of their credit limit.

6. North Carolina

Another Southern state, North Carolina, cracks our top 10. Residents of the Tar Heel State struggle to pay their credit card debt. Just under half of credit card payments are made late, which is the ninth-worst rate in the study. However North Carolina residents only carry $2,600 in credit card debt per capita, an above average score. One concern however is that credit card debt on the rise. In 2014, the average North Carolina resident held $2,500 in credit card debt, while in 2015 that figure was $2,600. That is a growth of 4%.

7. (tie) California

In a recent article we found that California is the most debt-saddled state in the union, so it is no huge surprise to see them in this top 10. California residents carry the second-highest amount of credit card debt in the top 10. On a per capita basis residents owe $3,060 to credit card companies. The picture looks worse once we take income into consideration. The median individual annual income in California is $28,068. So paying off the per capita credit card debt in full would require 10.9% of the average Californian’s income. For that metric California ranks fifth in the country.

7. (tie) New Mexico

Residents of the Land of Enchantment are tied with the Golden State when it comes to bad credit card habits. New Mexico residents tend to make late credit card payments. The average resident here makes about 0.47 late payments per billing cycle. As we mentioned previously, late payments can cause your credit score to take a hit. Plus, a large chuck of credit card debt in New Mexico is delinquent. New Mexico ranks in the top 15 for both those metrics.

9. (tie) New York

Few residents carry as much credit card debt as those in New York state. New York residents have $3,380 in credit card debt per capita. That’s equal to around 11.1% of the state’s annual individual median income. For both those metrics, New York ranks in the top 10. Interestingly, despite those high debt numbers, New Yorkers tend to pay their credit card bills on time. The average resident makes about 0.35 late payments per billing cycle, which ranks 29th in the country, a score almost good enough to drag New York out of the top 10.

9. (tie) South Carolina

South Carolina residents take the opposite attitude to credit card debt than New York residents do. In South Carolina residents carry $2,380 in credit card debt per capita, which is only 9.6% of median individual annual income. If those two metrics were the only ones we considered, South Carolina would be nowhere near the top 10. And yet, despite the relatively small amount of debt they carry, South Carolina residents appear to struggle to pay it off on time. Over 8% of credit card debt in South Carolina is delinquent and 54.6% of payments are made late. In both these metrics, South Carolina ranks fifth.

Data and Methodology

In order to find the states with the worst credit card habits, we looked at data on 47 different states and Washington, D.C. We did not have data for three states – Delaware, New Hampshire and New Jersey – so those states were excluded from our study. For the remaining states (plus D.C.) we looked at the following five metrics:

- Credit card debt per capita. Data is from 2015 and comes from the Federal Reserve Bank of New York (specifically from the New York Fed Consumer Credit Panel/Equifax).

- Credit card debt as a percent of median individual annual income. Data on credit card debt is from 2015 and is from New York Fed Consumer Credit Panel / Equifax. Data on incomes is from 2015 and comes from the U.S. Census Bureau’s American Community Survey.

- Credit card delinquency rate. This is the percent of all outstanding credit card debt which is at least 90 days delinquent. Data is for 2015 and comes from the Federal Reserve Bank of New York (specifically from the New York Fed Consumer Credit Panel/Equifax).

- Late payment rate. This is the number of late payments made per billing cycle. Data comes from the Experian’s 2015 State of Credit Report.

- Utilization rate. This is the percent of credit being used by the total amount of credit available. Data comes from Experian’s 2015 State of Credit Report.

We ranked each state across each of the metrics, giving equal weight to all metrics. Then we found the average ranking for each state. We based our final score off of this average ranking. The state with the highest average ranking received a 100. The state with the lowest average ranking received a 0.

Questions about our study? Contact press@smartasset.com.

Photo credit: ©iStock.com/asiseeit