It’s not always easy to keep up with our spending. Sometimes, before you know it, you’ve ignored your credit card bill for way too long and your issuer sends the debt to collections. That’s gonna hurt your credit. But how long does negative information stay on a credit report? The exact length of time is determined by the Fair Credit Reporting Act and some state laws.

How Long Does Negative Information Stay on My Credit Report?

The length of time that a piece of negative information stays on your credit report may depend on the entry. For starters, there are collection accounts, or charge-offs. These are one of the worst items you can have on a credit report. A charge-off happens when you have failed to pay back a debt for so long that the lender passes off the debt to a collection agency. The agency then continues after you to get you to pay the amounts back. A charge-off will remain on your credit report for seven years. This period begins on the date the account first became past due and was sent to collections.

A tax lien is another type of negative information on your report. This lien is the government’s claim on your property when you fail to pay your taxes. You should pay this back as soon as you can. Once you pay it off, the lien will remain on your report for seven years from that date. If you leave the lien unpaid, it will remain on your report indefinitely. This is why it’s so important to work out a payment plan with the IRS if you cannot pay your taxes in full.

The longest time a piece of negative information will stay on your credit report is 10 years. This term length occurs when you file for Chapter 7 or Chapter 11 bankruptcy. A non-discharged or dismissed Chapter 13 bankruptcy also falls into this category. However, a discharged Chapter 13 bankruptcy will remain on your credit report for seven years. These entries remain on your report from the date you file for bankruptcy.

Other types of negative credit information include foreclosures, unpaid credit accounts, defaulted loans and public records of judgments against you. Unpaid credit accounts include unpaid credit card bills. Judgments against you include situations like you being sued for unpaid rent sent to collections. These types of information will typically remain on your credit report for seven years.

It’s important to note that certain states, like New York and California, have exceptions to these rules. In New York, satisfied judgments will remain on your report for only five years from the date filed. Paid collections will also remain for only five years from the date of last activity or the date you paid the collection. In California, paid or released tax liens will remain on your report for seven years from the date released or 10 years from the date filed. Otherwise, unpaid or unreleased tax liens will remain for 10 years from the file date.

The Impact of Negative Information on Your Credit Report

Needless to say, having negative entries in your credit report harms your credit pretty badly. This is especially true if you have multiple negative entries. Plus, seven to 10 years seems like a long time for something to keep causing damage. But there is some good news. As time goes on, each negative entry will have less of an effect on your credit. So after six-and-a half years, for example, a charge-off will matter less than it did when it first appeared on your report.

So as your negative information ages, you credit gets to repair. Of course, that won’t happen without any action from you! You’ll need to make sure you avoid any other negative credit outcomes. It won’t hurt to add more positive entries either.

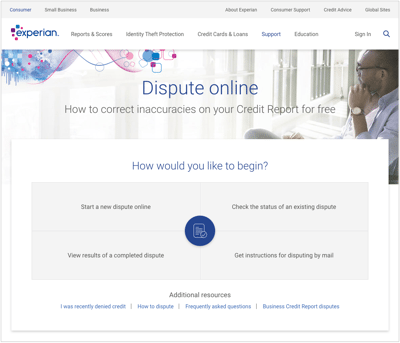

How to Dispute Negative Information

There is always the possibility that a piece of negative information on your credit report is actually incorrect. In that case, you can dispute the entry. You can do this by sending a letter about the entry to the credit bureau and the creditor that submitted the entry. For example, let’s say you see on your Experian credit report that your credit card issuer sent your debts to collections. However, you know that you paid off your debts to the issuer directly. In that case, you can reach out to both Experian and your credit card issuer to dispute the entry.

It will always help to provide copies of any documentation that support your argument. In this example, that would include statements and receipts showing your debts as paid. This will strengthen your case, especially if a creditor cannot back up their own claims. If you win the dispute, the entry should be removed from your report. (You’ll want to double check that it is removed.) If your dispute is denied, you can add a statement to your credit report, detailing the circumstances of your negative entries.

How to Boost Your Credit

While negative info can stay on your credit report for seven years, good entries can stay for up to 10 years. This means your paid debts and loans will reflect well upon your report for longer than a negative entry will. Doing good goes a long way with your credit, while the bad stuff becomes less damaging to your credit over time.

If you need to clean up your credit, you can start by finding if there are any errors. Then you can dispute those errors to have them removed by the bureaus. Of course, you can’t really dispute negative entries that you caused. In that case, decide how you can lessen the harm an entry does. For example, will an entry loosen up if you pay it instead of leaving it unpaid? It can help to get rid of the bigger debts first, then move on to the more trivial ones.

Finally, if you have a habit of missing payments or falling into debt, definitely work on improving those credit habits. Spend only what you can afford when using a credit card. Pay back your debts on time, and if you can, pay them in full. That way, you can stop carrying balances and more easily avoid falling into debt.

Bottom Line

Negative information can stay on your credit report for a long time, hurting your credit and your financial opportunities. While each entry’s harm lessens over time, you can’t rely on time to heal your credit report’s wounds. You should take as much action as you can to repair your credit, like repaying debts and building good credit. That way, you can more actively fight the harm a piece of negative information does to your report.

Tips for Maintaining Good Credit

- It can be easy to fall into credit card debt. You spend and spend on your credit card, knowing that money isn’t coming directly out of your checking account. Then all of a sudden you get your credit card bill and you owe way more than you realized. It’s important to use your card only for what you can truly afford. That way, you can actually afford to pay your credit card bill and avoid carrying over debt.

- Should you end up with a negative entry on your credit report, like a charge-off, you should immediately see what you can do to fix it. You can’t always reverse it. Plus, that usually can only be done by paying in full and negotiating with the creditor. However, it can still help to talk to the creditor and pay back what you can.

Photo credit: ©iStock.com/Pekic, Experian, ©iStock.com/Zinkevych