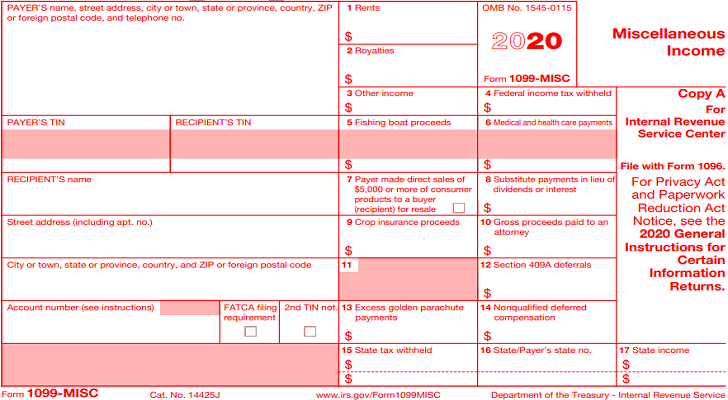

If you’re a contractor, freelancer or another type of self-employed individual, you’ll likely need to file IRS Form 1099-MISC. This form is used to report non-employee compensation, and it is part of the 1099 family of IRS tax forms. In fact, it’s one of the most commonly used 1099 forms. As its name suggests, the form is used to report miscellaneous income, which is why “MISC” is included in its title. Note that starting in the 2020 tax year, Form 1099-MISC will be changing to Form 1099-NEC.

A financial advisor can provide much needed help during tax season. Use SmartAsset’s free matching tool to find an advisor near you.

What Is Form 1099-MISC, and What Is It Used For?

IRS Form 1099-MISC is used to report income earned by those who are not employees of the company or organization that paid them. Taxpayers who might use the form include freelancers, sole-proprietors, self-employed individuals and independent contractors. The form must be filed by anyone who has received at least $600 in:

- Rent

- Services performed by non-employees, such as freelancers

- Prize and award money

- Healthcare payments

- Crop insurance

- Payments from a notional principal contract

- Payments to a lawyer

- Fishing boat proceeds

- Cash payments for fish purchased from anyone involved in the business of catching fish

Form 1099-MISC should also be filed by anyone who received at least $10 in royalties or broker payments. Those who report more than $5,000 in consumer product sales designed to be resold by a non-permanent retail establishment must also file the form.

For the 2020 tax year, Form 1099-MISC will be changing to Form 1099-NEC, which stands for “non-employee compensation.” Taxpayers will use this new form to report non-employee payments in the same way that Form 1099-MISC is used currently. Because this form is new for tax year 2020, you won’t receive it until the beginning of 2021.

Who Receives Form 1099-MISC?

As a freelancer or sole proprietor, you should receive a copy of Form 1099-MISC from any client who paid you at least $600 during the previous tax year. The form should show up within the first couple of months prior to Tax Day.

There are five separate copies of Form 1099-MISC, one of which is for IRS use only. Here’s a breakdown:

- Copy A goes to the IRS.

- Copy 1 goes to the recipient’s state tax department.

- Copy B is kept by the recipient.

- Copy 2 goes along with the taxpayer’s state tax return.

- Copy C is kept by the taxpayer.

Bottom Line

While IRS Form 1099-MISC won’t be around for much longer, it’s still important to understand how it works given that Form 1099-NEC will basically work the same in 2021 and beyond. Not everyone needs to worry about Form 1099-MISC. However, anyone who’s earned at least $600 in non-employee income should keep an eye out for their copy in the mail.

Tips for Filing Your Taxes

- A financial advisor can help you navigate tax season when things get too difficult to do on your own. Finding the right financial advisor doesn’t have to be hard. SmartAsset’s free tool matches you with financial advisors in your area in just five minutes. Get started now.

- Taxes are complicated, but you don’t have to go at them alone. SmartAsset has several free resources, including an income tax calculator and a property tax calculator, that you can use to predict and manage your taxes.

Photo credit: IRS.gov, ©iStock.com/Pra-chid