The number of registered investment advisors (RIAs) in the U.S. is growing, as are the number of clients they serve and assets they manage. According to an annual report published jointly by the Investment Advisor Association and National Regulatory Services, there were 13,494 RIAs in 2020 – about 11% more than there were in 2017 (12,172). Last year, those advisors reported a total of 42.1 million clients and $97.2 trillion in regulatory assets under management (AUM) – roughly 18% and 37% more, respectively, than the number of clients and assets reported three years prior.

Though there has been growth across the industry, some advisors have expanded their practices more quickly than others. In this study, we identified the 50 fastest-growing RIAs in the U.S. Eliminating firms that took part in mergers or acquisitions – to isolate organic growth – we compared financial advisors across four metrics: one- and three-year percentage change in number of client accounts and one- and three-year percentage change in AUM. Our Data and Methodology section below has more details on advisory firm selection criteria and how we used the data to assemble our final rankings.

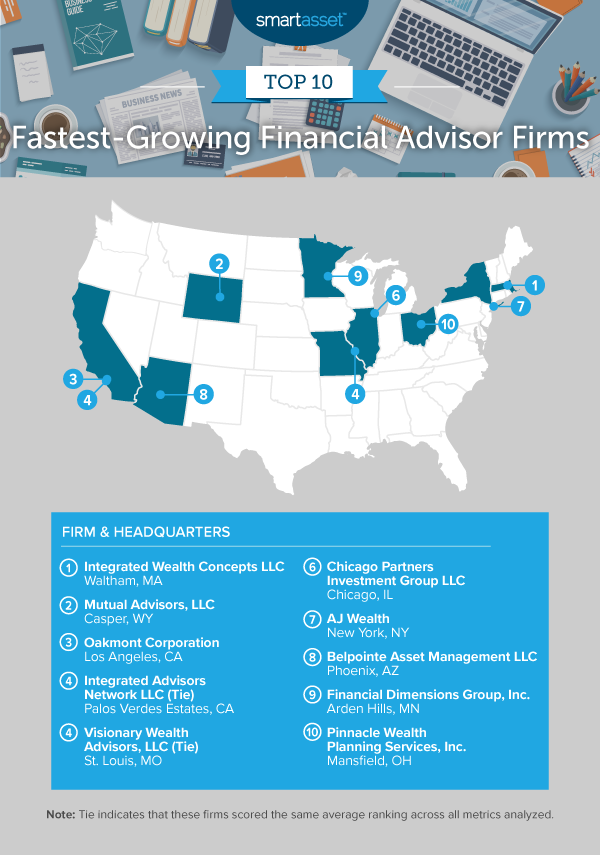

Key Findings

- Younger firms take the lead. Six of the top 10 fastest-growing financial advisory firms were founded within the past decade: Integrated Wealth Concepts, LLC; Mutual Advisors, LLC; Integrated Advisors Network LLC; Visionary Wealth Advisors, LLC; AJ Wealth; and Financial Dimensions Group, Inc. The most recently formed among those is our top-ranking firm – Integrated Wealth Concepts, LLC – which was founded in 2016.

- Growth is slower among advisory firms in the South. Only four of the top 50 fastest-growing financial advisors in our study are in the South, according to Census regional divisions. In fact, none of the top 10 fastest-growing financial advisors is headquartered in the South. Heritage Wealth Advisors, the highest-ranking Southern firm, claims 19th place on our list and is headquartered in Richmond, Virginia.

- Two family offices appear in our top 50. Oakmont Corporation – ranking third – and Dyson Capital Advisors, LLC – ranking 21st – are both family offices. Though each firm had fewer than 100 client accounts as of its most recent Form ADV filing in December 2020, the total number of accounts at both offices grew by upwards of 80% during the previous three years. Additionally, from 2017 to 2020, AUM at Oakmont Corporation and Dyson Capital Advisors grew by about 142% and 82%, respectively.

1. Integrated Wealth Concepts LLC – Waltham, MA

Integrated Wealth Concepts LLC, also known as Integrated Partners, ranks first in our study, growing both its client base and assets managed significantly over the past several years. Integrated Wealth Concepts has the 10th-largest 2017-2020 increase in number of client accounts and greatest increase in AUM of all advisory firms in our study. According to its Form ADV filings with the SEC, the number of client accounts grew from 3,500 to almost 16,400 during that three-year interval, and total AUM increased from $550 million to almost $3.5 billion. In the past year alone, the number of accounts and AUM grew by about 87% and 158%, respectively.

2. Mutual Advisors, LLC – Casper, WY

Mutual Advisors, LLC ranks as the No. 2 fastest-growing financial advisor firm, growing its client base by more than 307% – from about 2,400 to roughly 9,800 – and its total assets under management by more than 261% – from $776.9 million to $2.8 billion – from 2017 to 2020. Meanwhile, between 2019 and 2020, the client count at Mutual Advisors, LLC grew by 44%, and its AUM increased by 54.84%.

3. Oakmont Corporation – Los Angeles, CA

A family office, Oakmont Corporation is the smallest financial advisory firm within our top 10 in terms of number of clients. At the end of 2020, Oakmont Corporation served a total of 90 clients – with 51 more clients than in 2019, a 130.77% jump in just one year. The firm ranks eighth overall for its one-year change in AUM (70.96%) and 12th for its three-year change in AUM (142.44%).

4. Integrated Advisors Network LLC (tie) – Palos Verdes Estates, CA

At the end of 2020, Integrated Advisors Network LLC had almost $1.5 billion in AUM, about 160% and 44% more than it did in 2017 and 2019, respectively. Relative to other advisor firms in the study, that is the 24th-highest one-year percentage change in AUM and 10th-highest three-year percentage change in AUM. Integrated Advisors Network has also expanded its client base. From 2017 to 2020, the number of accounts held there more than doubled – growing from just over 3,100 to more than 6,600.

4. Visionary Wealth Advisors, LLC (tie) – St. Louis, MO

Visionary Wealth Advisors, LLC ties with Integrated Advisors Network, LLC as the No. 4 fastest-growing financial advisor in our study. The number of clients working with Visionary Wealth Advisors more than doubled between 2017 and 2020, growing by about 118%. At the end of 2020, Visionary Wealth Advisors’ total AUM stood at about $1.1 billion – 92.42% and 80.19% more than at the end of 2017 and 2019, respectively.

6. Chicago Partners Investment Group LLC – Chicago, IL

As of its most recent December 2020 SEC filing, Chicago Partners Investment Group LLC served about 3,700 clients – almost 88% more than it did in 2017 and about 75% more than it did in 2019. Chicago Partners Investment Group LLC also has the 32nd- and 15th-highest three- and one-year changes in AUM, growing by 107.36% between 2017 and 2020, and by 52.35% from 2019 to 2020.

7. AJ Wealth – New York, NY

Based in New York City, AJ Wealth manages almost 900 client accounts and has about $1.5 billion in AUM. AJ Wealth’s client count is 84.81% higher than it was in 2017 and 23.21% higher than it was in 2019. Additionally, its one- and three-year percentage changes in AUM are the 10th- and eighth-highest in our study, respectively.

8. Belpointe Asset Management LLC – Phoenix, AZ

Belpointe Asset Management, LLC had the 18th-largest 2017-2020 change in number of client accounts (259.87%) and seventh-highest 2017-2020 increase in AUM (178.53%). Belpointe Asset Management also ranks in the top 30 financial advisors for its one-year percentage change in the number of client accounts. According to the Form ADV filings, the number of client accounts grew from about 6,200 to more than 9,600 between December 2019 and December 2020.

9. Financial Dimensions Group, Inc. – Arden Hills, MN

Ranking as our top financial advisor in Arden Hills, MN, Financial Dimensions Group, Inc. takes the ninth spot in this study. Financial Dimensions Group has the 33rd- and 28th-highest three-year changes in client count and assets managed, respectively. More recently, from 2019 to 2020, Financial Dimensions Group grew its number of clients by 32.31% and AUM by 38.40% so that as of December 2020, it had more than 5,200 clients and about $1.3 billion in AUM.

10. Pinnacle Wealth Planning Services, Inc. – Mansfield, OH

Pinnacle Wealth Planning Services, Inc. saw the eighth-highest three-year change in number of client accounts of all the firms in our study, with its number of client accounts growing from almost 450 to almost 2,300 from 2017 to 2020. Additionally, from 2019 to 2020, AUM increased by 90.42% to more than $1.3 billion – the fifth-highest rate for this metric overall.

Data and Methodology

To put together our report, we began by identifying all firms that are registered with the U.S. Securities & Exchange Commission (SEC) and headquartered in the U.S. All SEC-registered firms are legally required to abide by fiduciary duty and must report essential information about their business to the SEC.

To refine our list further, we removed any firms that have disclosures on their Form ADV, as well as firms that do not offer financial planning services or do not serve individual investors. We additionally eliminated firms with less than $500 million in assets under management as of their December 2017 SEC filing. Finally, to isolate organic growth, we eliminated firms who took part in mergers and acquisitions during the time frame by cross referencing Fidelity’s annual M&A reports and through our own research and due diligence.

With that criteria, we compared more than 600 firms across the following four metrics:

- One-year percentage change in number of client accounts. Data comes from the SEC and is for December 2019 and December 2020.

- Three-year percentage change in number of client accounts. Data comes from the SEC and is for December 2017 and December 2020.

- One-year percentage change in assets under management. Data comes from the SEC and is for December 2019 and December 2020.

- Three-year percentage change in assets under management. Data comes from the SEC and is for December 2017 and December 2020.

We ranked each advisory firm in every metric, giving all metrics an equal weighting. We then found each firm’s average ranking and used the average to determine a final score. The firm with the highest average ranking received a score of 100. The firm with the lowest average ranking received a score of 0.

Please note, this study does not evaluate the quality of services provided to clients and is not indicative of the financial advisor firms’ future business performance. Neither the RIA firms nor their employees paid a fee to SmartAsset in exchange for inclusion in our rankings.

Tips for Sourcing Clients in the New Year

- Partner with us. Between March and August of 2020, online searches for the term “financial advisor” jumped by nearly 20%, but many advisors weren’t able to capitalize on the trend. While it can take some time to build a brand for your firm online, some lead generation services can help you scale quickly. SmartAsset’s SmartAdvisor platform matches certified financial advisors with new, local clients throughout the U.S. If you are looking to scale your business, be sure to consider us as a potential organic growth partner.

- Expand your radius. SmartAsset’s financial advisor survey shows that 60% of participating prospects indicated that they were willing to work with an advisor remotely. Consider broadening your search and working with investors who are more comfortable with less frequent in-person meetings.

Questions about our study? Contact us at press@smartasset.com.

Photo credit: ©iStock.com/skynesher