Three financial documents can evaluate the health of a business: the balance sheet, the income statement and the cash flow statement. Each measures and reports on different aspects of a company’s financial condition. However, the balance sheet and income statement hold particular importance.

Balance Sheet

A balance sheet looks at assets and liabilities at a specific point in time. Companies typically measure those assets and liabilities at the end of a year or quarter. A third important element of a balance sheet, owner’s equity or shareholder’s equity, comes from the other two. The formula looks like this:

Assets = shareholder’s equity + liabilities

There are different types of assets. Fixed assets may include plant, equipment and real estate. However, other asset categories include current assets, cash, marketable securities, accounts receivable and inventory. Intangible assets, meanwhile, feature intellectual property, trademarks and patents.

Liabilities are what the company owes. For example, they may include the unpaid balance of loans used to purchase plant and equipment. However, they also could include mortgages taken out when acquiring real estate. Other types of liabilities include accounts payable, rent, taxes, utilities, wages and dividends.

The company’s journal entries feature assets and liabilities. As a result, a company calculates shareholder equity by taking total assets minus liabilities. However, the company may consider shareholder equity its net worth. For example, say a company pays off shareholders by liquidating assets. In that case, shareholder equity is what would be left.

What a Balance Sheet Says

The balance sheet can indicate the financial stability of a company. Consequently, creditors, lenders and investors use a balance sheet when determining whether the firm is liquid enough to pay debts.

Managers use a balance sheet to determine if they can take on more debt for expansion, among other decisions. As a result, balance sheets are useful for comparisons. Looking at balance sheets for two different points can show whether the firm’s financial position has improved. For example, you can look at a company at the end of one year and the end of the previous year. Meanwhile, people often compare a company’s balance sheet to others in the same business.

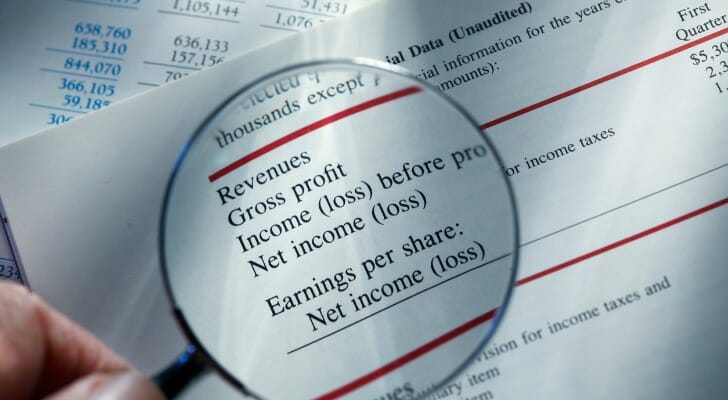

Income Statement

An income statement shows revenues and expenses over a period of time. For example, the period may be a month, a quarter or a year. However, the income statement uses revenues and expenses to generate a profit or loss figure. The formula is:

Income – expenses = profit or loss.

An income statement begins with a figure for revenue, sales or net sales. Meanwhile, the company records revenues in a ledger as credits.

The company subtracts various expenses from the revenue figure. Expenses may include labor, materials, supplies, utilities, or rent advertising costs. They are often lumped together in broad categories such as cost of goods sold (COGS) and selling, general and administrative (SG&A) expenses. As a result, companies enter expenses as debits.

Balance Sheets vs. Income Statements

Once expenses are subtracted from revenues, operating revenue remains. To find net income, a company subtracts other costs not already included. For example, those costs may include interest expense and tax payments. Net income is the bottom line shown in the final line of the income statement. If net income is negative, the company has lost money for the period.

The income statement shows whether a company is generating a profit. Consequently, it can help managers identify problems reducing profits and opportunities for increasing profits. It shows lenders whether a company is generating enough profit to service debts. Investors see healthy profits as a sign of a well-run company competing effectively and likely to increase in value.

Bottom Line

A balance sheet looks at assets, liabilities and shareholder’s equity as measured at a point in time. An income statement shows income, expenses and profit or loss over a period of time. Taken together, they can help guide and inform decisions by managers, investors, lenders and others.

The cash flow statement tracks flows of cash into and out of the company. This critical document helps ensure that a company has enough cash to pay its bills. The other two – balance sheets and income statements – are equally important.

Investing Tips

- Finding a financial advisor who knows investing doesn’t have to be hard. SmartAsset’s free tool matches you with up to three vetted financial advisors who serve your area, and you can interview your advisor matches at no cost to decide which one is right for you. If you’re ready to find an advisor who can help you achieve your financial goals, get started now.

- With the cash flow statement, these balance sheet and income statement provide essential information about a company’s financial operations, profitability and stability. However, if you’re still unsure how an investment may perform, if it fits your risk profile, or how much taxes and inflation will affect it, consider consulting SmartAsset’s investment calculator.

Photo credit: ©iStock.com/DNY59, ©iStock.com/fizkes