With both established brokerages and new companies offering investment apps, the options can be overwhelming. There are apps for every kind of investor, from the beginner just looking to dip a toe in the water to seasoned day traders who want to analyze individual stocks on the go. Check out our top picks.

Managing your investments on your own can be overwhelming. Find a financial advisor today.

The features that are most important depend on your investing goals and the budget you’re working with. We’ve rounded up a collection of apps for every kind of investor out there, whether you are making your first trade or have been doing it for decades. For each app on this list, we’ve provided user ratings on both the iTunes store (for iPhone/iPad apps) and Google Play store (for Android apps); they are current as of this article’s update.

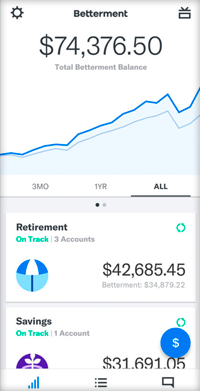

Wealthfront: Best App for Low-Maintenance Investors

Apple App Store Rating: 5/5

Google Play Store Rating: 4.6/5

Wealthfront, founded in 2008 and purchased for $1.4 billion in January 2022 by UBS, is a robo-advisor that invests your money in a portfolio of low-cost exchange-traded funds (ETFs) and (in some cases) individual stocks. Portfolios typically contain six to eight ETFs from a larger catalog spanning 11 different asset classes.

Once you’ve opened an account and answered a few questions about your goals and risk tolerance, Wealthfront will take it from there. Proprietary software will automatically rebalance your portfolio as needed, allowing you to focus on other things.

In terms of fees, you’ll face a 0.25% account management fee. However, if you refer a friend who then funds an account, both of you will have the fee waived for the first $5,000.

You’ll need at least $500 to open a brokerage account with Wealthfront. That’s high relative to other investing apps on this list, but it’s still a relatively low figure when it comes to investing. Also keep in mind that, since Wealthfront is a robo-advisor, you won’t be able to have a hand in fund selection or making trades.

Customers interested in cryptocurrency may now invest up to 10% of their portfolio in Grayscale Bitcoin Trust and Grayscale Ethereum Trust.

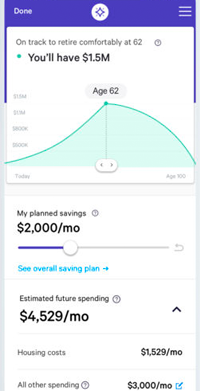

Betterment: Best App for Tax-Efficient Investing

Apple App Store Rating: 4.7/5

Google Play Store Rating: 4.5/5

Betterment, founded in 2008, has the distinction of being the first publicly available robo-advisor. Betterment’s software creates custom portfolios for each user based on an initial survey.

Betterment says that it wants to save its investors more on taxes than any other service. Like many robo-advisors (including Wealthfront and Stash), Betterment automatically conducts tax-loss harvesting on all accounts. But Betterment takes things one step further with its asset location strategy. This strategy helps clients with both taxable accounts and retirement accounts ensure that different investments are allocated into both accounts in the most tax-efficient way. For the investor focused on the after-tax return above all else, Betterment is an attractive choice. (Note: If you’re really focused on tax-optimizing your portfolio, we’d recommend finding a financial advisor who specializes in tax planning.)

Like Wealthfront, its most direct competitor, Betterment charges a 0.25% account management fee for its digital plan and 0.40% for its premium plan. However, Betterment has no account minimum, so you can start with as small an investment as you like.

With a premium portfolio, you can receive guidance on outside investment accounts and speak to certified financial planners (CFPs) over the phone 24/7. The premium portfolio comes with an account minimum of $100,000.

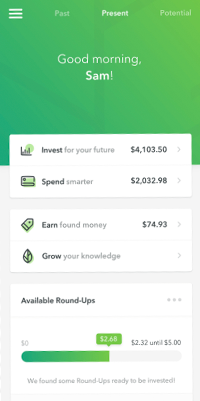

Acorns: Best App to Help You Save

Apple App Store Rating: 4.7/5

Google Play Store Rating: 4.5/5

If you want to start investing but aren’t diligent about saving money, Acorns may be the app for you. Acorns is a robo-advisor that saves your spare change for you.

Link your debit and credit cards to Acorn and the app will “round up” purchases on these cards to the next dollar. It then invests this “change” in a portfolio of BlackRock and Vanguard exchange-traded funds (ETFs). You can gradually save and build your portfolio without even realizing that you’re doing it. There are just a handful of pre-made investment options, which makes Acorns great for investors who don’t want to spend hours scouring research and comparing stocks

In addition to the spare change method, you can also set up one-time or recurring deposits in your investment account if you like. You can open a standard investment account called Acorns Core or an individual retirement account (IRA) known as Acorns Later.

While you can choose from a range of portfolios from conservative to aggressive, that’s the only customization available to you. The app charges $3 per month for a personal account and $5 per month for a family account.

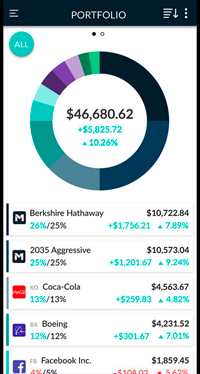

M1 Finance: Best App for Stock Picking and Automated Investing

Apple App Store Rating: 4.7/5

Google Play Store Rating: 4.5/5

M1 Finance is an app for long-term investors who want the choice between hand-picking stocks and letting the app invest for them. With M1, investors can choose a model portfolio powered by a robo-advisor; manually select a portfolio of stocks (including fractional shares) and ETFs; or choose a mix of both strategies. The hybrid setup makes the app a great fit for investors who want some flexibility.

M1 offers a taxable account and an IRA account. Both are fee-free provided you invest at least $100 or $500, respectively. Investors who want a line of credit with a flexible payback schedule would need to have at least $10,000 in their account. With that they can borrow up to 35% of their account balance. For an annual $125 fee, you can upgrade from M1 Basic to an M1 Plus, which offers a lower rate on the line of credit (2.25% vs. 3.75%), more stock options and other benefits. On the downside, this app doesn’t offer minute-to-minute trading functionality or have much in the way of research materials. If you’re looking to read up on potential stocks or ETFs, you’ll need to do it outside the app.

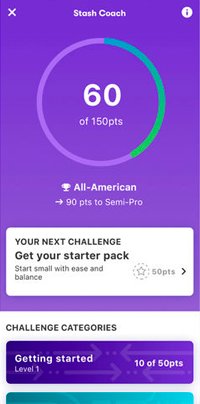

Stash: Best App for Rookie Investors

Apple App Store Rating: 4.7/5

Google Play Store Rating: 4/5

Stash is designed to help beginners make their first foray into investing. It caters to these beginners with its ample educational content and its Stash Coach feature. Stash Coach is part game, part educational tool, and it’s designed to help you better understand investing.

When you first download the app, you’ll answer a few questions to establish how risk-averse you’d like to be and what your goals are. Then, the app will suggest a collection of ETFs and individual stocks for you and populate the education tab with content tailored to your situation.

The actual act of building your portfolio will be up to you, as Stash only provides suggestions. However, the app may nudge you in a different direction if your portfolio isn’t diversified.

You’ll need only $5 to start investing with Stash, thanks to the ability to purchase fractional shares of the 110 individual stocks available within the app. With Stash Growth, you can open a taxable account with a retirement account (traditional or Roth IRA) for $3 per month or, with Stash+, a taxable account, retirement account and two accounts for kids for $9 per month.

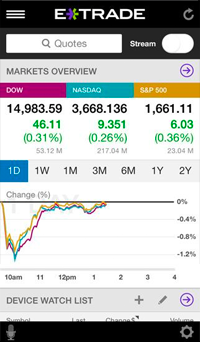

E-Trade: Best App for Investment Selection

Apple App Store Rating: 4.6/5

Google Play Store Rating: 4.1/5

The E-Trade mobile app is for the trader who likes having a lot of investment options. You’ll have access to thousands of stocks, options, futures, ETFs, mutual funds, bonds and more. There is no commission for online trading of stocks, mutual funds or ETFs, ,and there is no minimum balance required.

In addition to trading capabilities, the app has news and market analysis from CNBC, MarketWatch and Morningstar. You can also set up personalized stock alerts and compile watchlists of investments to more easily keep tabs. If you’d rather not do all the work yourself, you can choose E-Trade Core Portfolio, E-Trade’s robo-advisor offering. You’ll need a minimum balance of $500, and you’ll pay a 0.30% fee.

TD Ameritrade: Best App For Research

Apple App Store Rating: 4.5/5

Google Play Store Rating: 3.6/5

The mobile app of TD Ameritrade, which was bought by Charles Schwab in 2019 for $26 billion, is well suited for the investor who wants as much market research as possible. There’s also a series of educational videos designed to teach you about different investing strategies.

Additionally, you can check up on your investments, view a breakdown of your portfolio and make trades, all within the app. Finally, you can set up alerts so that you’re notified of breaking news or when a stock hits a certain price.

There is no required account minimum. The firm offers free trades of equities and ETFs. Customers also have access to some 3,700 mutual funds with no transaction fees. Options trades are $0.65.

In addition to the standard TD Ameritrade mobile app, the brokerage firm also has a standalone TD Ameritrade Trading app, which mobilizes its “thinkorswim” trading platform. This is meant for confident investors who want more customization. Online stock and ETF trades are commission-free.

Tips for New Investors

- If you find investing sizable amounts of money intimidating, you don’t have to do it alone; a financial advisor can be a great resource. If you don’t have a financial advisor yet, finding one doesn’t have to be hard. SmartAsset’s free tool matches you with up to three vetted financial advisors who serve your area, and you can interview your advisor matches at no cost to decide which one is right for you. If you’re ready to find an advisor who can help you achieve your financial goals, get started now

- Diversify your assets across several asset classes and economic sectors. That way, the success of your portfolio isn’t overly dependent on one area of the market.

Photo Credit: ©iStock.com/vm, ©Robinhood.com, ©Acorns.com, ©iTunes.com, ©Etrade.com