Since hitting a three-year low in June 2020, shares of Berkshire Hathaway (BRK-A and BRK-B) have been climbing and investors are pouring over its annual letter for clues as to why. It’s often said that investing in Berkshire Hathaway is like buying into an exchange-traded fund (ETF). Both offer diversification across industry sectors. But while ETFs are often passively invested, seeking to track a benchmark index, Berkshire Hathaway actively buys stocks and businesses. As you explore whether or not investing in Berkshire Hathaway is a good idea for you, it can help to get some hands-on help from a financial advisor.

How to Buy Berkshire Hathaway Stock With a Brokerage Account

One way to buy Berkshire Hathaway stock is to open an online brokerage account and use it to purchase the shares you want. This can be a fairly simple and straightforward process that may vary slightly based on what brokerage you decide to use. The general steps to buying Berkshire Hathaway stock with a brokerage account are:

Step 1: Choose What Type of Shares You Want

Berkshire Hathaway stocks trade on the New York Stock Exchange. The company offers two types of shares: Class A and Class B. Berkshire’s Class A shares (BRK-A) are significantly more expensive than Class B shares (BRK-B). This is because they have never split, despite the price being in the six figures now. Buffet actually created Class B shares so that his company would be within reach of small investors. Originally, they sold at 1/30 the price of Class A shares. But in 2010, they did a 50-to-1 split, so that Class B shares were selling at 1/1,500 the price of Class A shares.

Step 2: Select a Brokerage

Once you know which Berkshire shares you can afford, you’ll need to select a brokerage. Some firms have in-person and over-the-phone services, whereas others are entirely online platforms or apps. When you’re comparing brokerages, keep an eye out for commissions charges for stock trades and any significant minimum investment requirements.

Brokerage Comparison

| Brokerage Firm | Trading Fees | Minimum | Best For |

| Merrill Edge Read Review | $0 for online trades; $29.95 for rep-assisted trades | $0 | – Bank of America account holders – Customer support users |

| TD Ameritrade Read Review | $0 for online trades; $25 for broker-assisted trades | $0 | – Online traders – Customers who value support |

| Robinhood Read Review | $0 for online trades; $10 for broker-assisted phone trades | $0 | – Mobile/online traders – Self-sufficient investors |

Step 3: Fund Your Account

Now that you’ve selected your brokerage, it’s time to fund your account. Before you can purchase the shares you want you’ll have transfer money from a bank account to your new brokerage account. Whatever your brokerage account balance is becomes how much money you can spend on investments.

Step 4: Buy Berkshire Hathaway Shares

Once your account is funded, it’s time to grab your slice of Berkshire Hathaway. Many brokers will provide two distinct means of purchase: limit orders and market orders. If you think the current price of Berkshire’s stock is right, you can place a market order for the number of shares you want. A limit order, on the other hand, allows you to set a specific price that Berkshire shares must reach before your account triggers a purchase.

How to Buy Berkshire Hathaway Stock With a Financial Advisor

Although costlier than an online brokerage account, a financial advisor is a great investment alternative for newbie investors or individuals who don’t have time to manage an account personally. More than advising you on when or whether to buy Berkshire Hathaway stock, an advisor can help you build an investment portfolio that aligns with your risk tolerance and goals. Investors often overlook this holistic approach, but the rewards for working with an experienced professional can be substantial.

Buying shares with a financial advisor is typically much more straightforward than doing it on your own through a brokerage. This is because your financial advisor will generally manage all of your finances so they will actually go out and buy the shares, or have a brokerage buy the shares, in your behalf. All you have to do is sign the paperwork your financial advisor gives you so that they can act on your behalf, provide them access to your funds, and then give them the go-ahead to make the purchase.

It should be noted that the extent to which your financial advisor can complete this type of transaction is dependent on your agreement with them.

Berkshire Hathaway Stock Overview

A holding company is a business that owns many other companies, and Berkshire Hathaway is the cream of the crop. Warren Buffett, aka the Oracle of Omaha, and his team are always looking for new stocks to bring into Berkshire’s group of holdings. If you invest in Berkshire Hathaway, you’re likely someone who trusts Buffett’s decision-making.

Overview of Companies That Berkshire Hathaway Owns Partly or Wholly

| Banks and Financial Services | – American Express – Bank of America – Bank of New York Mellon – Mastercard – Moody’s Corporation – U.S. Bancorp – Visa – Wells Fargo & Co. |

| Food and Beverage Companies | – Coca-Cola – Kraft-Heinz |

| Retail Services and Technology | – Amazon – Apple – Kroger – Procter & Gamble – Verisign, Inc. |

| Healthcare and Pharmaceuticals | – Bristol Meyers Squibb – DaVita Inc. – Johnson & Johnson – Merck & Co. – Teva Pharmaceutical |

Berkshire Hathaway Financial Profile

It’s rare to call a company’s stock “blue-chip.” This signifies that it has attained a high level of long-term reliability. Berkshire Hathaway either fully or partially owns many such companies, making it a blue-chip conglomerate by association.

According to a report from Investopedia, a $1,000 investment in Class A Berkshire shares in 1964 would’ve netted you 52 shares at $19 each. The report then goes on to claim that, as of January 2016, those same shares would be worth $9,861,280. That rate of return clearly illustrates how strong of an investment Berkshire Hathaway has been under Buffet’s leadership. (He turned 91 years old in August 2021.)

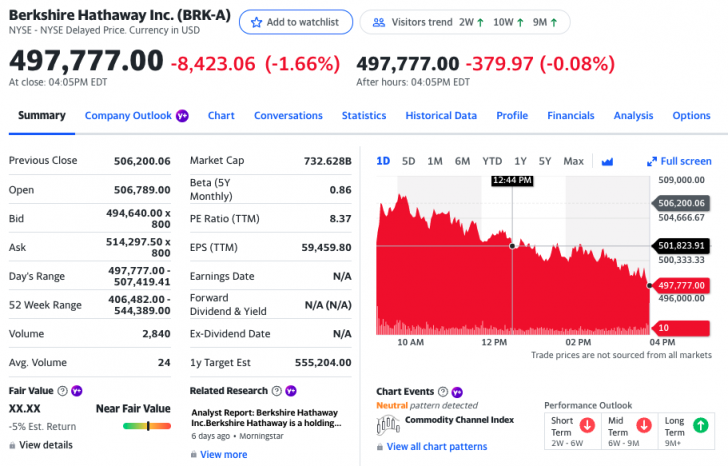

(Past performance does not indicate future results. Chart from April 2022.)

Bottom Line

Buying Berkshire Hathaway stock can be pretty straightforward whether you decide to open a brokerage account or hire a financial advisor to help. It’s the investment choices that are more difficult. Class A stock prices as high as Berkshire Hathaway’s is beyond the reach of small investors. If you can’t afford roughly $500,000 for one share, you should consider the company’s Class B shares. Alternately, you could try fractional share investing.

Tips on How to Choose a Financial Advisor

- Finding a qualified financial advisor doesn’t have to be hard. SmartAsset’s free tool matches you with up to three financial advisors who serve your area, and you can interview your advisor matches at no cost to decide which one is right for you. If you’re ready to find an advisor who can help you achieve your financial goals, get started now.

- To prepare for your initial meeting, take a look over our questions to ask a financial advisor. They will provide key information you need to make your final decision. Pay close attention to the advisor’s regulatory past, as well as how they’re compensated.

Photo credit: ©iStock.com/Nikada, Yahoo Finance, ©iStock.com/skynesher