Monte Carlo simulation is a mathematical technique for considering the effect of uncertainty on investing as well as many other activities. A Monte Carlo simulation shows a large number and variety of possible outcomes, including the least likely as well as the most likely, along with the probability of each outcome occurring. Investors, financial advisors, portfolio managers and others can use the Monte Carlo Method to make better decisions when conditions are uncertain.

There are a number of ways to gauge the risk of a potential investment, and a financial advisor can walk you through all of them.

People making investment decisions often assume some figure such as the historical average annual rate of return for an asset will likely hold true in the future. Using this input, often along with others similarly derived, they produce a single forecast that drives their decisions.

However, while the average may indeed be somewhat stable and predictable, an average can mask wide variations in annual rate of return that may also occur. A Monte Carlo simulation can help an investor see the possible effects of many different rates of return, rather than just looking at the average or any other fixed value. The Monte Carlo Method can do the same for other sorts of analysis, including those with a large number of variables.

For instance, when planning a retirement strategy, a number of important factors can influence the result of any decision. Age at retirement, market trends, health, marital status and other elements are, to varying degrees, uncertain, and changing any of them can have a significant impact on the outcome of selecting a particular strategy. The Monte Carlo method helps identify how each of these factors and more can influence what happens make it easier to make the best decision.

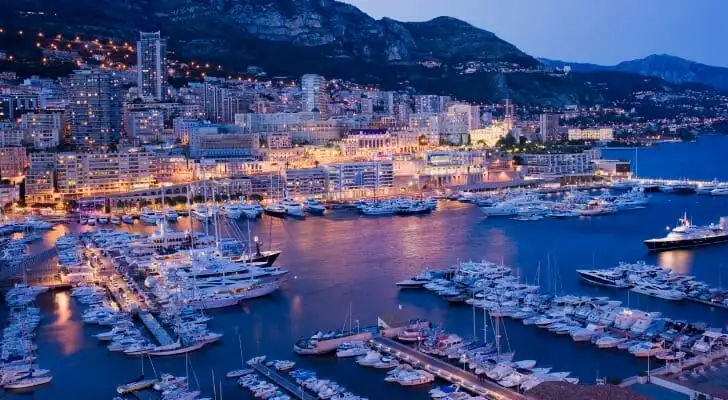

Monte Carlo forecasting was developed during World War II when Manhattan Project scientists including John von Neumann wanted to avoid wasting limited supplies of uranium on approaches to making the atom that weren’t likely to succeed. They named the forecasting method for the city in Monaco that is known for its gambling casinos. Now it is applied to forecasting corporate income, selecting optimum retirement strategies and many other activities.

How Monte Carlo Simulations Are Calculated

It is possible to do Monte Carlo simulations using ordinary spreadsheet software, but many forecasts use specialized statistical software packages to generate the simulations. Another approach is to use a forecasting add-on to a standard spreadsheet package to enable Monte Carlo simulations. Rather than producing one forecast, a Monte Carlo simulation produces a large number of possible outcomes. Often, Monte Carlo forecasts generate thousands of different possible outcomes. These are frequently displayed in graphic form, giving investors a visual cue to help them make investment decisions.

There are three basic steps to creating a Monte Carlo simulation.

- The forecaster selects the dependent variable that will be predicted as well as the independent variables or inputs that will control the dependent variable. For instance, if the ending value of an investment in fixed-income securities is the dependent variable, the inputs might include annual inflation, interest rates, unemployment figures and gross domestic product growth.

- Next the forecaster defines a range of value for the input and assigns probability weighting to each value. For instance, the annual inflation rate that has been the most common historically would likely receive a higher weighting than a very high or very low inflation rate that had only occurred once or twice in recent history.

- Now the forecaster runs a series of simulations, each using randomly generate values for the independent variable inputs. If there are many inputs, the number of potential combinations and outcomes can be very large. Often forecasters run thousands or tens of thousands of simulations to make sure they have a representative sample of possible outcomes.

The Bottom Line

The Monte Carlo Method is a sophisticated mathematical simulation tool that allows forecasters to account for the potential variation of many variables that may affect an outcome, including investment outcomes. For example, it enables forecasters to do sensitivity analysis, finding out which inputs have the biggest impact on the final outcomes. Monte Carlo simulations also enable scenario analysis, allowing forecasters to identify the input values associated with specific outcomes. In addition, they can help to correlate inputs.

Tips for Investing

- If you are seeking an optimal retirement strategy or make critical investment decisions that could benefit from the Monte Carlo Method, consider working with a financial advisor with experience modeling outcomes in complex situations. If you don’t have a financial advisor yet, finding one doesn’t have to be hard. SmartAsset’s free tool matches you with up to three vetted financial advisors who serve your area, and you can interview your advisor matches at no cost to decide which one is right for you. If you’re ready to find an advisor who can help you achieve your financial goals, get started now.

- Once you’ve decided on an optimal strategy, you’ll have to decide on an asset allocation that’s appropriate for that strategy. And unless you invest in a target date fund that automatically adjusts that asset allocation, you’ll have to rebalance your assets over the course of your investing time frame. That’s where an asset allocation calculator can save you a great deal of time.

Photo credit: ©iStock.com/Deejpilot, ©iStock.com/anneleven, ©iStock.com/MicroStockHub