While the coronavirus pandemic has impacted millions of Americans with businesses shuttering and companies laying off employees, the secondary home market is seeing an unexpected surge. Remote workers are temporarily relocating from larger cities to less dense, more comfortable spaces.

The real estate brokerage firm Redfin reported that the demand for second homes jumped 100% in October 2020 when compared to the previous year. This outpaces the demand for primary homes, which only saw a 50% increase during that same period in their study. Keeping in mind that many remote workers are still looking for second homes, SmartAsset crunched the numbers to find out which secondary home markets are the most popular.

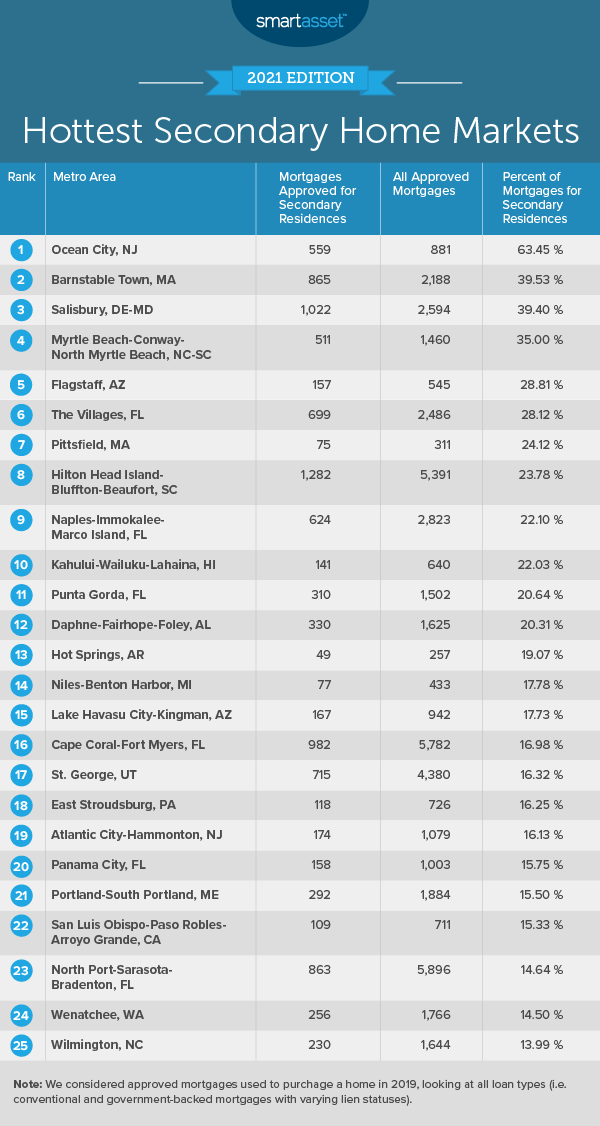

To find the hottest secondary home markets, we found the number of mortgages issued for secondary homes in 2019 in nearly 400 metro areas across the country. We then divided this by the total number of mortgages issued to calculate the percentage of the market made up of second homes. For details on our data sources and how we put all the information together to create our final rankings, check out the Data and Methodology section below.

This is SmartAsset’s fourth study on the hottest secondary home markets in the country. Check out the 2020 version here.

Key Findings

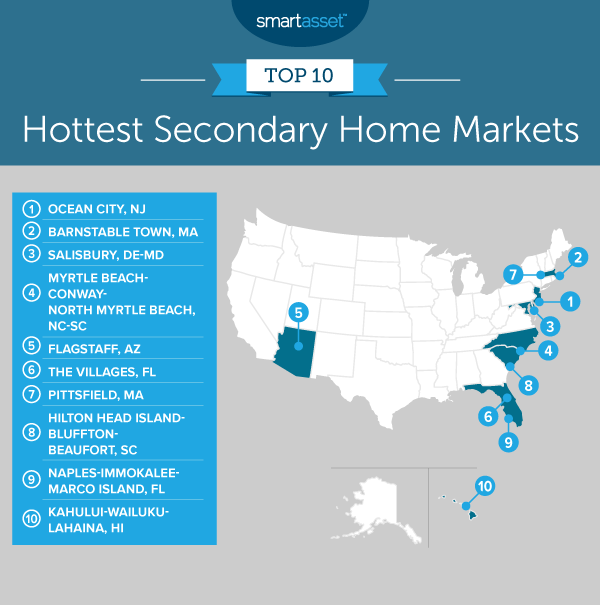

- Life’s a beach. The top of this study is dominated by cities that are near the beach. In fact, six of the top 10 metro areas are located right on the shore. One of those beach towns – Ocean City, New Jersey – claims first place in this study, and is the only city where more than half of the mortgages approved in 2019 were for secondary residences. The five other sandy seaside spots in the top 10 are Barnstable Town, Massachusetts; Myrtle Beach, North Carolina-South Carolina; Hilton Head Island, South Carolina; Naples, Florida; and Kahului, Hawaii. Almost one in three mortgages across all of these metro areas are for secondary homes.

- The Midwest does poorly. While almost one-fourth of the cities in our study are located in the Midwest, only one – Niles-Benton, MI, at No. 14 – is ranked in the top 25. The majority of the metro areas at the top are in the Northeast, South and West, according to Census regional divisions.

1. Ocean City, NJ

Ocean City, New Jersey claims first place in our study, with 63.45% of its mortgages being taken out for secondary homes. This means that 559 out of 881 total mortgages in 2019 were for secondary residences.

2. Barnstable Town, MA

Barnstable Town, Massachusetts had 2,188 new mortgages taken out in 2019. While the majority of those were for primary residences, 865 mortgages were for secondary homes, accounting for 39.53% of the total.

3. Salisbury, DE-MD

The Salisbury metro area covers parts of Delaware and Maryland. It had 2,594 new mortgages in 2019. And 39.40%, or 1,022 of them, were taken out for secondary homes.

4. Myrtle Beach-Conway-North Myrtle Beach, NC-SC

The Myrtle Beach metropolitan area is divided between North and South Carolina. There were 1,460 new mortgages there in 2019. And 35.00% of those were used to buy secondary homes. This means that 511 were for secondary residences, while 949 were for primary homes.

5. Flagstaff, AZ

Flagstaff, Arizona is the only metro area in the top 10 that is located in the Southwest. There were 545 new mortgages in 2019, and 157 of those, or 28.21%, were taken out for second homes.

6. The Villages, FL

The Villages is an active community for seniors in Florida, with 28.12% of mortgages belonging to the secondary home market. There were a total of 2,486 new mortgages in 2019, and 699 of those were taken out for second residences.

7. Pittsfield, MA

Pittsfield, Massachusetts had only 311 new mortgages in 2019, which is actually the 35th-lowest amount for this figure across all 396 metro areas in the study. However, 75 of those mortgages (24.12%) were claimed by the secondary home market, elevating Pittsfield to seventh place overall.

8. Hilton Head Island-Bluffton-Beaufort, SC

Hilton Head is a South Carolina island that is famous for its beaches and golfing. There were 5,391 new mortgages in the Hilton Head Island-Bluffton-Beaufort metro area in 2019, and 1,282 of those (23.78%) were taken out for second homes.

9. Naples-Immokalee-Marco Island, FL

The Naples-Immokalee-Marco Island, Florida metro area is located on the Gulf of Mexico, and 22.10% of its new mortgages in 2019 were taken out for secondary residences. This means that 624 out of the total 2,823 were for secondary homes.

10. Kahului-Wailuku-Lahaina, HI

This metro area located on the Hawaiian island of Maui rounds out our top 10. There were only 640 new mortgages in the Kahului-Wailuku-Lahaina area in 2019. But 22.03%, or 141 of them, were for second homes.

Data and Methodology

To find the hottest secondary home markets in the U.S., we looked at data for 396 metro areas across the following two metrics:

- Number of mortgages approved for secondary residences in 2019.

- Total number of mortgages approved in 2019.

We divided the number of mortgages approved for secondary residences by the total number of mortgages approved for each metro area. The metro area with the highest number of non-primary residence mortgages as a percentage of all approved mortgages ranked highest. The place with the lowest percentage ranked lowest.

Data for both metrics comes from the Consumer Financial Protection Bureau’s Home Mortgage Disclosure Act Database.

Tips for a Successful Second Homeownership

- Planning for two homes? Two heads are better than one. If you want to own a second home someday, it makes sense to have someone help you get a handle on your finances now. Finding the right financial advisor doesn’t have to be hard. SmartAsset’s free tool matches you with financial advisors in just five minutes. If you’re ready to be matched with advisors, get started now.

- Smart mortgage management. Make sure you know what your mortgage payment will be using SmartAsset’s free mortgage calculator.

- It pays to read the fine print. Don’t forget about closing costs! These costs may not be as high as other parts of home buying, but all the costs you have can add up, so don’t discount anything.

Questions about our study? Contact press@smartasset.com.

Photo credit: ©iStock.com/pixdeluxe