Whether due to societal changes or lack of savings, many Americans have delayed homeownership. According to a National Association of Realtors report, the median age of first-time homebuyers in 2019 was 33 years old, three years older than it was a decade prior. Moreover, a recent Zillow analysis shows that the typical first-time homebuyer now rents for six years before settling down in one place, more than double the amount of time needed in the early 1970s.

These increases in age and average time spent renting by today’s first-time raises an important question for many: How long does it take to become a homebuyer? In large part, this is determined by your salary, savings rate and the price of the home you hope to buy. In this study, SmartAsset examined how long it takes to become a homeowner, on average, in the 100 largest U.S. cities, accounting for a 20% down payment on the median-valued home in each place. We also calculated the estimated time to homeownership in the 15 largest U.S. cities, assuming a 10% or 20% down payment. Our Data and Methodology section below lays out the specific metrics we used and the assumptions we made to find how long it takes to become a homeowner in different cities.

SmartAsset previously looked at where it takes the least time for renters to become homeowners. Check out that study here.

Key Findings

- Texas dominates the top 10 cities that have the lowest estimated time to homeownership. Four of the top 10 cities where it takes the least time for renters to become homeowners are in Texas. The estimated time for renters to become homeowners is less than two and a half years in the cities Corpus Christi, Laredo, El Paso and Arlington.

- Homeownership may be more possible than one would think in large cities. The average estimated time to homeownership for renters is less than five years in 10 of the 15 largest U.S. cities. In fact, assuming a 10% down payment rather than a 20% one, 13 of the 15 cities have an estimated time to homeownership of roughly five years or less. Los Angeles, California and New York, New York are the only two that miss that mark. The estimated time to homeownership assuming a 10% down payment on the median valued home and average closing costs in Los Angeles and New York is 5.34 and 6.86 years, respectively.

Cities Where It Takes the Least Time for Renters to Become Homeowners

To calculate the average time to homeownership in the 100 largest U.S. cities, we looked at data across five metrics: median household income, effective income tax rate, median annual rent, median home value and average closing costs. Using income, tax rates and rent figures, we calculated income after taxes and rent in each city. We assumed renters would be able to save 40% of their post-tax and rent income annually. We divided the upfront costs for a home, including a 20% down payment on the median-valued home and average closing costs, by that savings figure to estimate an average length of time for homeownership to be achieved. For details on our data sources and how we put the information together to create our final rankings, check out the Data and Methodology section below.

1. Fort Wayne, IN

Of the 100 largest U.S. cities, Fort Wayne, Indiana ranks as the city with the lowest estimated time to homeownership. Census data from 2018 shows that the median household income in Fort Wayne is about $48,700. After taxes and rent, the average household has about $31,200 left over in disposable income. Assuming 40% of that figure is saved annually, the average household could afford the upfront costs for a home in about two years.

2. Detroit, MI

Detroit, Michigan ranks second on our list of the cities where it takes the least time for renters to become homeowners. The relatively quick time to homeownership for renters in Detroit is in large part a product of low home prices in the city. Census data shows that the median home value in Detroit was $51,600 in 2018 – the lowest of any city in our study.

3. Toledo, OH

We estimate that the average time to homeownership for renters in Toledo, Ohio is 2.16 years. The 2018 median household income in Toledo was about $35,900. Though this is below the national average, homes in Toledo are relatively affordable – with a median home value of $79,900 – making homeownership more possible for many residents there.

4. Corpus Christi, TX

Census estimates from 2018 show that the median household income in Corpus Christi, Texas is about $56,600. Additionally, the median home value is $146,000. Using those figures along with the previously described methodology, we estimate that the average time to homeownership in Corpus Christi is less than two years and three months.

5. Laredo, TX

Laredo is the second of four Texas cities that rank in the top 10 of our study. The average household may be able to save about $12,400 annually. Assuming average upfront home costs of roughly $28,100, the estimated time to homeownership is 2.26 years.

6. Wichita, KS

Wichita, Kansas ranks sixth in our study out of a total 100 cities for which we analyzed data. The median household income in Wichita is almost $51,100 and median home value is slightly less than $140,000. Using those figures, we found that the average household may be able to afford the upfront costs for a median valued home in the city in 2.31 years.

7. Omaha, NE

The median home value in Omaha, Nebraska is relatively expensive, the second-highest of any city in our top 10 – $163,400, according to 2018 Census data. Though this higher value indicates a larger down payment, residents in Omaha may not need to wait long to make the jump from renting to owning. The average household income after taxes and rent is almost $38,500 and assuming 40% of this can be saved annually, the average renter could purchase a home in 2.33 years.

8. Cleveland, OH

Average upfront home costs in Cleveland, Ohio are the second-lowest of any city ranking in our top 10, at about $17,500. With the median household earning almost $30,000 annually and potentially saving about $7,200 every year, the estimated time to homeownership in Cleveland is 2.43 years.

9. El Paso, TX

Renters in El Paso, Texas may be able to purchase a home in a little less than two and a half years. A 20% down payment on the median valued home in El Paso is about $26,200. With average closing costs at about $3,100, a household needs a total of roughly $29,300 to put down on a home.

10. Arlington, TX

Average upfront home costs in Arlington, Texas are the highest of any city in our top 10, though households are generally able to save for these costs in less than three years because of high average incomes and low taxes. Census Bureau data from 2018 shows that the median household income in Arlington is almost $63,100. After taxes and rent, the average household has about $40,800 left over.

Estimated Time to Homeownership in the 15 Largest U.S. Cities

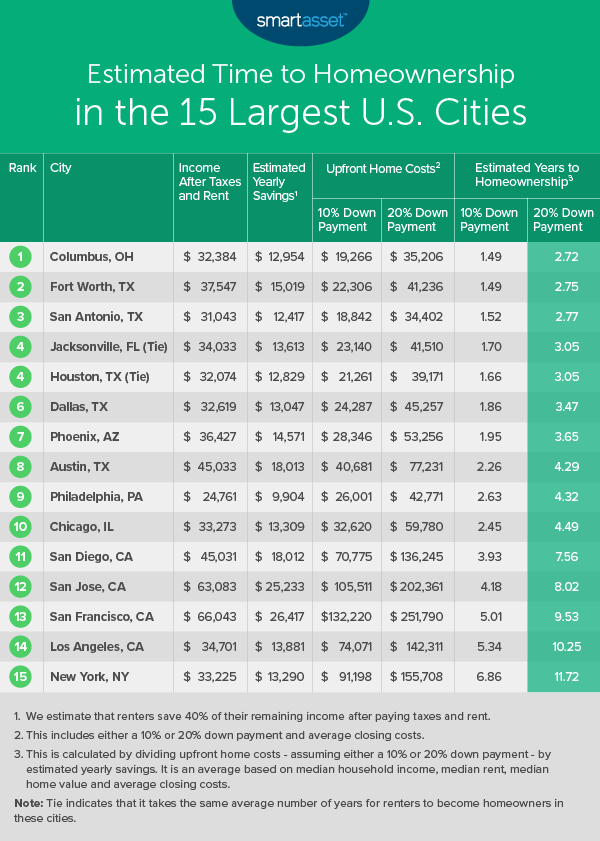

Beyond uncovering the cities where it takes the least time for renters to become homeowners, we examined the estimated time to homeownership in the 15 largest cities in the U.S. Due to the fact that not everyone puts down 20% on a home, we also considered how the estimated time to homeownership changes assuming a 10% down payment on the median valued home.

Across the 15 largest cities, Columbus, Ohio has the lowest estimated time to homeownership. The average household could afford the upfront costs of buying a home in 2.72 years if putting down 20% on a house. Alternately, if the average household in Columbus put down only 10% on the median valued home, the household could achieve homeownership in less than a year and a half.

Large Texas cities also rank well. In Fort Worth, San Antonio, Houston and Dallas – which each rank within the best six cities out of the total 15 – the average household can afford the upfront costs of buying a home, assuming a 20% down payment, in less than three and a half years on average. Lowering the upfront costs by assuming a 10% down payment and average closing costs, the estimated time to homeownership is less than two years in all four cities. The table below shows how the 15 largest U.S. cities stack up.

Data and Methodology

To find cities where it takes the least average time for renters to become homeowners, we considered five metrics:

- Median household income. Data comes from the Census Bureau’s 2018 1-Year American Community Survey.

- Effective income tax rate. Data comes from SmartAsset’s income tax calculator.

- Median annual rent. Data comes from the Census Bureau’s 2018 1-Year American Community Survey.

- Median home value. Data comes from the Census Bureau’s 2018 1-Year American Community Survey.

- Average closing costs. Data is from SmartAsset’s closing costs calculator and is calculated at the county level.

Using median household income, effective income tax rate and median annual rent, we calculated income after taxes and rent in each city. We assumed households currently renting would be able to save 40% of their post-tax and rent income annually. Then, using median home value and average closing costs, we calculated the upfront costs for a home. We assumed a 20% down payment for the 100 largest U.S. cities and included both a 10% and 20% down payment as part of our considerations for the 15 largest cities. We divided the upfront costs for a home by 40% of post-tax and rent income to find the average amount of time to homeownership for a renter in each city.

Home Buying Tips

- Mortgage management. Our study only accounts for the upfront costs of buying a home. It’s important to know, however, what you’ll be paying each month and for how long. To get a sense of what that might look like, check out SmartAsset’s free mortgage calculator.

- Buy or rent? Even if you have the savings to buy a home, be sure it makes sense to change over from being a renter. If you are coming to a city and plan to stay for the long haul, buying may be the better option for you. On the other hand, if your stop in a new city will be a short one, you’ll likely want to rent. SmartAsset’s rent or buy calculator can help you see the cost differential between purchasing a home or apartment relative to renting.

- Seek out trusted advice. Thinking about buying a home? It may make sense to get some professional help. Finding the right financial advisor doesn’t have to be hard. SmartAsset’s free tool matches you with financial advisors in your area in five minutes. If you’re ready to be matched with local advisors that will help you achieve your financial goals, get started now.

Questions about our study? Contact us at press@smartasset.com

Photo credit: ©iStock.com/danny4stockphoto