A good deal can make a significant difference for any purchase you make, but especially when you’re investing your hard-earned money in property like a home. As a result, it’s important not to overlook the fact that the asking price is negotiable – it could save you hundreds or thousands down the line that you could use for home improvements or mortgage payments instead. That’s why SmartAsset crunched the numbers to find out where in the U.S. a little extra strategizing can pay off the most.

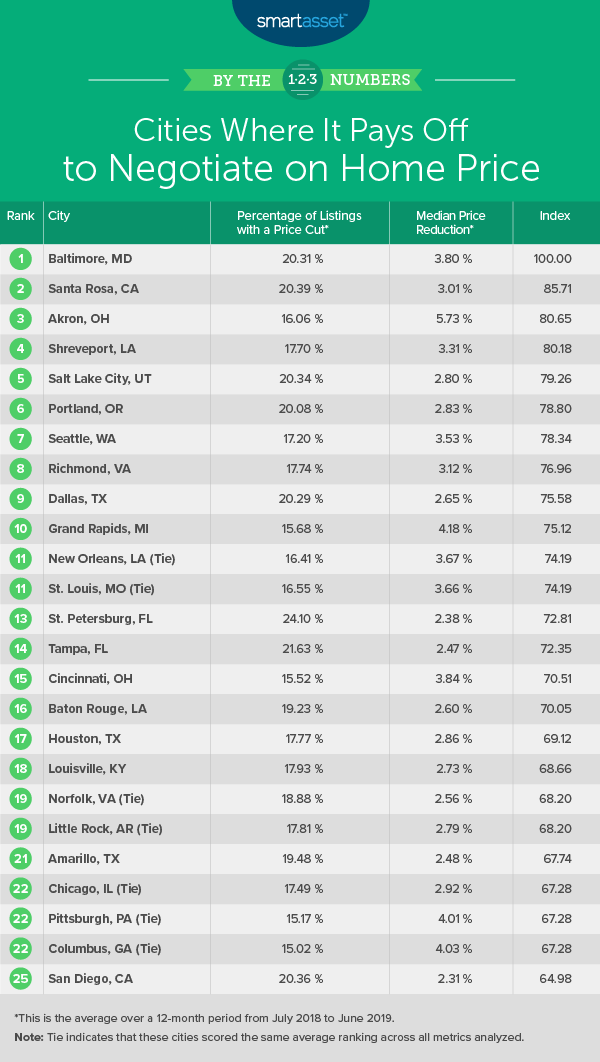

To find the cities where it pays off the most to negotiate on home price, we analyzed 150 cities across the following metrics: percentage of home listings with a price cut and median price reduction. For details on our data sources and how we put all the information together to create our final rankings, see the Data and Methodology section below.

Key Findings

- No Northeast. Prominent cities in the Northeast like New York, Philadelphia and Boston rank 92nd, 38th and 96th, respectively. The first Northeastern city on our list – Pittsburgh – appears at No. 23.

- Southern cities populate top 25. Using Census divisions, we note that 14 of our top 25 cities are located in Southern states. Between July 2018 and June 2019, an average of 18.88% of home listings across those 14 cities had price reductions. Of the remaining 11 cities in our top 25, there are five each in the West and Midwest and only the one representative in the Northeast.

1. Baltimore, MD

Baltimore, Maryland ranks in the top 20 of all 150 cities for both the percentage of listings with a price cut and the median price reduction of those listings. According to data from Zillow, over a 12-month period spanning from July 2018 to June 2019, an average of 20.31% of homes for sale had price cuts, and the median price reduction for those listings month-over-month was 3.80%.

2. Santa Rosa, CA

Santa Rosa, California ranks as the second-best city to negotiate on a home, with comparable figures to the No. 1 city of Baltimore. Between July 2018 and June 2019, an average of 20.39% of home listings had price reductions, and the median price reduction for those listings month-over-month was 3.01%.

Notably, homes in Santa Rosa are generally more expensive than those in Baltimore. In June 2019, the median listing price for homes in Santa Rosa was $635,000 compared to $169,900 in Baltimore.

3. Akron, OH

For homebuyers looking for inexpensive homes with additional price cuts, Akron, Ohio may be a great option. According to data from Zillow, the median listed home value in Akron was $79,900 in June 2019. Additionally, Akron’s median price cut month-over-month of 5.73% is the highest of any city in our top 10. Assuming a homebuyer negotiated for a price cut of 6%, slightly above the median, on a home listed for $80,000, he or she would save $4,800, more than enough to cover the average closing costs of a home in Ohio.

4. Shreveport, LA

Located in northwest Louisiana, Shreveport ranks 43rd and 32nd across all 150 cities on our two metrics of listings with a price cut and the percentage of that price cut, respectively. Those are top-third rankings. Between July 2018 and June 2019, an average of 17.70% of home listings had price cuts.

5. Salt Lake City, UT

Utah’s capital, Salt Lake City, has a particularly strong No. 14 for percentage of home listings with a price cut. Between July 2018 and June 2019, an average of 20.34% or one-fifth of home listings had price cuts. The median price cut for those listings month-over-month was 2.80%, the 63rd highest across all cities.

6. Portland, OR

The median price reduction on homes tends to be a bit lower in Portland, Oregon than other cities in our top 10, but price reductions are frequent. Between July 2018 and June 2019, an average of about one-fifth of home listings had price cuts. The median price cut for those listings month-over-month was 2.83%. Take a look at our top financial advisors in Portland if you’re considering buying a home there.

7. Seattle, WA

In gross terms, homebuyers in Seattle, Washington who successfully negotiate may have the most to gain relative to homebuyers in any other city in our top 10. The median listing price for homes in Seattle, Washington is the highest of any city in our top 10. In June 2019, the median listing price for homes in the city was $699,000 according to data from Zillow. For homebuyers who are able to negotiate for the median price reduction month-over-month of 3.53%, they would save almost $25,000 on the median home listing.

8. Richmond, VA

Relative to other cities in our top 10, Richmond, Virginia does equally well across each of the two metrics we considered in our study. It ranks 40th, a top-third rate, in terms of the average percentage of listings with a price cut and ranks similarly – 42nd to be exact – in terms of the median price reduction month over month. Specifically, between July 2018 and June 2019, an average of 17.74% of home listings had price cuts, and the median price cut for those listings month-over-month was 3.12%.

9. Dallas, TX

Dallas, Texas is the most populous city in our top 10, but despite the number of people vying for housing there, it’s still able to bargain on home price. According to Zillow, in the 12 months leading up to June 2019, an average of 20.29% of home listings had price cuts, and the median price cut for those listings month-over-month was 2.65%.

10. Grand Rapids, MI

Compared to the other nine cities in our top 10, a lower percentage of homes in Grand Rapids, Michigan have price cuts. The city ranks 74th for this metric out of all 150 cities in our study. Those cuts, however, are comparatively high: they’re the second-highest in our top 10 and 12th-highest overall. Specifically, an average of 15.68% of home listings have had price cuts over a 12-month period, and of those, there is a median price reduction of 4.18%.

Data and Methodology

In order to find the cities where it pays off the most to negotiate on home price, SmartAsset analyzed data across the largest 150 cities in the U.S. Specifically, we looked at the following two metrics:

- Percentage of listings with a price cut. This is the average percentage of current for-sale listings that experienced a price cut between July 2018 and June 2019.

- Median price reduction. This is the median price cut of the above-mentioned listings, month-over-month, for the same time period.

Data for both metrics comes from Zillow, which we then performed calculations on to reflect year-long averages.

First, we ranked each city in each metric. From there, we found each city’s average ranking, weighting each metric equally. We used each city’s average ranking to create our final score. The city with the best average ranking received a score of 100 while the city with the worst average ranking received a score of 0.

Tips for Managing Your Savings

- Invest early and invest in smart guidance. An early retirement requires early planning. By planning and saving early you can take advantage of things like compound interest. But why not get some sound guidance from an advisor first? Finding the right financial advisor that fits your needs doesn’t have to be hard. SmartAsset’s free tool matches you with financial advisors in your area in 5 minutes. If you’re ready to be matched with local advisors that will help you achieve your financial goals, get started now.

- Buy or rent? – When you’re moving to a new city, you need to decide if you are going to rent or buy. If you are coming to a city and plan to stay for the long haul, buying may be the better option for you; of course always bear in mind how much house you can afford. On the other hand, if your stop in a new city will be a short one, you’ll likely want to rent.

Questions about our study? Contact us at press@smartasset.com

Photo credit: ©iStock.com/Natee Meepian