Assembling enough money for a down payment is typically the largest hurdle to clear when securing a mortgage. The median home price in the U.S. is up 14% year-over-year, according to a November 2020 Redfin report, and as the housing market gets more expensive, so too will the deposit that you have to front for a home. Working with professional financial advisors can help you strategize so that your money’s doing the most for you, but in some places compared to others, scraping together that bundle of cash can be particularly daunting. Keeping all this in mind, SmartAsset investigated where it takes longest to save for a down payment.

To do this, we examined data on the 50 largest U.S. cities, using median home values, median income figures and assuming that workers would save 20% of their income each year. We calculated the years needed to save for both the recommended 20% down payment as well a 12% down payment (the median down payment among all homebuyers in 2019, according to the National Association of Realtors). For details on our data sources and how we put all the information together to create our final rankings, check out the Data and Methodology section below.

This is SmartAsset’s fifth look at how many years of work it takes to afford a down payment. You can read the 2020 edition here.

Key Findings

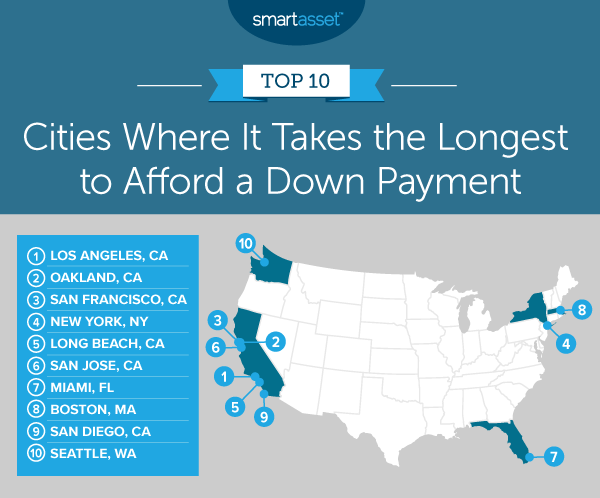

- Oakland takes over in the Bay. In the last three editions of this study, San Francisco homeowners have always needed to work longer than Oakland homeowners to afford a down payment. This year, however, Oakland has surpassed San Francisco and moved to the No. 2 spot, bumping the Golden Gate City to No. 3. San Francisco real estate is still pricier – with a median home value of more than $1.2 million – but the differences in average income make Oakland second only to Los Angeles on our list.

- It still takes less time in Midwestern and Southern cities to assemble funds for a down payment. Residents in the East Coast and West Coast cities that comprise our top 10 will need more than three times longer to save up for a down payment than residents in the Midwestern and Southern cities that comprise the bottom 10. To save up for a 20% down payment, those in the top 10 will need to work an average of 8.90 years, compared to only 2.83 years in the bottom 10. For a 12% down payment, it will take 5.34 years for residents in the top 10 cities to reach their home buying goals, while it will take 1.70 years for residents in the bottom 10 to do so.

1. Los Angeles, CA

It will take residents in Los Angeles, California the longest to save for a down payment. The median home value is $697,200, which means that they will need to save $139,440 for a 20% down payment. If a person earns the median household income of $67,418 and saves 20% of that each year, then he or she will need to work 10.34 years to have enough money to afford a down payment.

2. Oakland, CA

In Oakland, California where the median home costs $807,600, a 20% down payment equals $161,520. The median household income here is $82,018, so a person saving 20% annually will need to work for 9.85 years to afford a down payment. For comparison, saving up a 12% down payment of $96,912 will require 5.91 years, but this means having to pay significantly higher mortgage payments.

3. San Francisco, CA

The median home value in San Francisco, California is $1,217,500 – the only city in our study with a seven-figure price tag. A 20% down payment on that median value would cost $243,500. With a median household income of $123,859, the average person saving 20% annually could afford a down payment in 9.83 years.

4. New York, NY

In the Big Apple, homeowners will need 9.81 years to make a 20% down payment on a home. The median home value is $680,800, which means a 20% down payment is $136,160. And for a comparison, a New Yorker saving 20% annually at a median household income of $69,407 will need 5.89 years to save for a 12% down payment of $81,696.

5. Long Beach, CA

Long Beach, California has a median home value of $614,400. To buy the median house with a 20% down payment, the average resident will need $122,880. If you earn the median income of $67,804 and save 20% of your income each year, then you will be able to afford a down payment in 9.06 years.

6. San Jose, CA

San Jose, California is in the heart of Silicon Valley, and as you might expect, the median home value is fairly high – at $999,990. A 20% payment on that home value is $199,980. The median household income in the city is $115,893, so if a resident saves 20% of his or her income each year, then the person could afford a down payment in 8.63 years.

7. Miami, FL

Miami, Florida is the only Southeastern city in the top 10 of our study. The median home value is $358,500, which means that a 20% down payment costs $71,700. The median income in Miami, however, is $42,966. So a resident saving 20% of that median household income ($8,593) each year could afford a 20% down payment in 8.34 years.

8. Boston, MA

It takes someone saving 20% of the median household income in Boston, Massachusetts 7.93 years of work to afford a 20% down payment on a home. The median home value is $627,000, with a 20% down payment coming to $125,400. The median household income in Boston is $79,018.

9. San Diego, CA

The median home value in San Diego, California is $658,400, which means that a 20% down payment is $131,680. Someone earning the median household income of $85,507 will need 7.70 years to afford that down payment. For comparison, a 12% down payment of $79,008 takes 4.62 years to save up for, with the caveat that paying a smaller down payment now means larger mortgage payments later.

10. Seattle, WA

Seattle, Washington rounds out the top 10 on our list, with a median home value of $767,000. This means that a 20% down payment is $153,400. So if you earn the median household income of $102,486, then it will take you 7.48 years – saving 20% of your income each year – to afford that payment.

Data and Methodology

To rank the cities where the average household would need to save the longest to afford a down payment, we analyzed data on the 50 largest U.S. cities. We specifically considered two pieces of data:

- 2019 median home value.

- 2019 median household income.

Data for both factors comes from the Census Bureau’s 2019 1-year American Community Survey.

We started by determining the annual savings for households by assuming they would save 20% of the median annual pre-tax income. Next, we determined how much a 20% down payment as well as a 12% down payment for the median home in each city would cost. Then, we divided each of the estimated down payments in each city by the estimated annual savings. The result was the estimated number of years of saving needed to afford each down payment, assuming zero savings to begin with. Finally, we created our final ranking by ordering the cities from the greatest number of years needed to the least number of years needed for each.

Tips for Hassle-Free Home Buying

- Consider investing in expert advice. If you’re thinking of buying a home or starting to save, consider working with a financial advisor before you take the plunge. Finding the right financial advisor doesn’t have to be hard. SmartAsset’s free tool matches you with financial advisors in your area in five minutes. If you’re ready to be matched with local advisors, get started now.

- Prevent potential mortgage mishaps. The payments don’t stop after you’ve put money down; you’ll also need to make mortgage payments. Figure out what those might be before you move forward by using SmartAsset’s mortgage calculator.

- It pays to read the fine print. When thinking about your home buying transaction, don’t forget closing costs. These may seem small compared to the down payment, but every dollar counts.

Questions about our study? Contact press@smartasset.com.

Photo credit: ©iStock.com/valentinrussanov