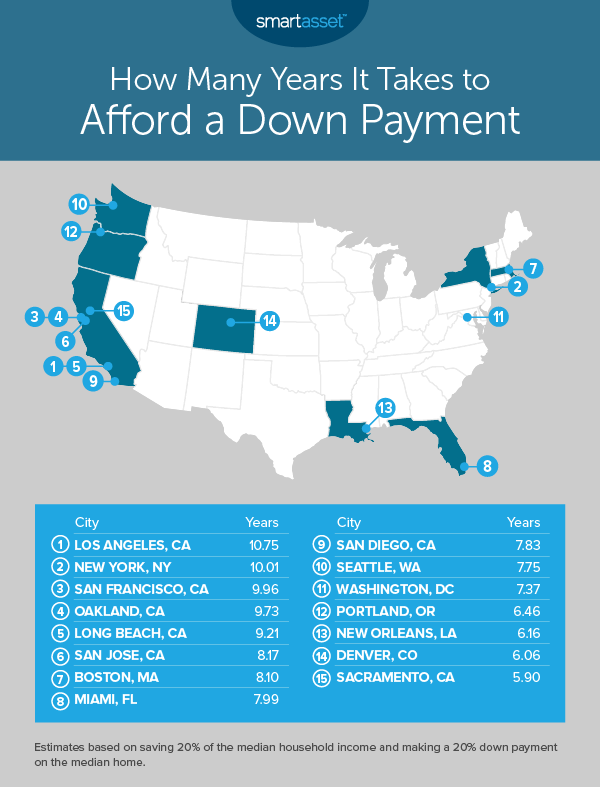

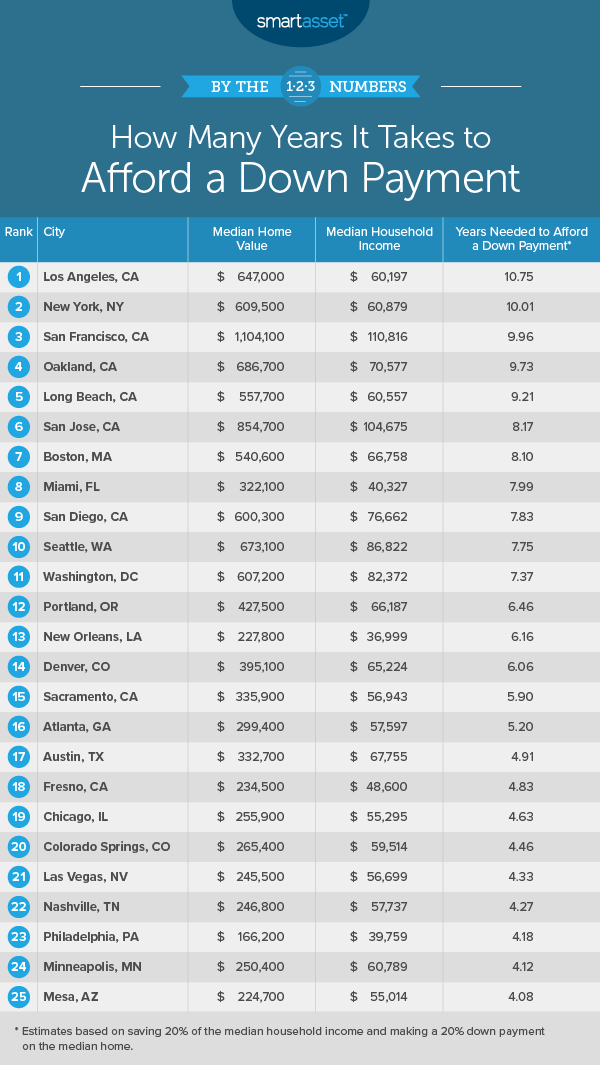

Owning a home is an important financial goal for many Americans. Data from the U.S. Census Bureau shows that at the end of 2018, approximately 64% of people owned their homes. Whether homeownership is affordable for you is the first question to consider, and it’s often a tough one. That’s especially true for buyers in some of America’s biggest cities. While the costs of homeownership may make realizing this dream seem aspirational, it doesn’t have to be. With more information and some sound planning, you may be able to achieve homeownership sooner than you think. Using a down payment of 20% as a benchmark, we investigated where you would need to save the longest to afford a down payment.

We created this ranking by considering how many years it would take to afford a 20% down payment on the median home in each of the 50 largest cities in the U.S. We used median income figures and assumed that workers would save 20% of their income each year. You can learn more about where we got our data and how we made our calculations in the Data and Methodology section below.

This is SmartAsset’s third look at how many years of work it takes to afford a down payment. You can see the 2018 rankings here.

Key Findings

- New York City leapfrogs San Francisco. The cities in our top three are the same as last year, but New York has overtaken San Francisco. Los Angeles still requires the most years to save for a down payment by far, but New York and San Francisco have both narrowed the gap.

- California cities remain expensive. Just like last year, six of the top 10 cities are in the Golden State. The San Francisco Bay Area leads the charge with three of the top six cities. Two of the top five cities are in Southern California.

- Homebuyers may want to move inland. In our top 15, there are 13 cities in coastal states. Of the bottom 15 cities in our study, which require the fewest years to save for a down payment, none of the cities is in a coastal state. Four of those bottom 15 cities are also in Texas. Millennials are moving to Texas more than to almost any other state.

1. Los Angeles, CA

Median home value: $647,000

Median income: $60,197

Years: 10.75

2. New York, NY

Median home value: $609,500

Median income: $60,879

Years: 10.01

3. San Francisco, CA

Median home value: $1,104,100

Median income: $110,816

Years: 9.96

4. Oakland, CA

Median home value: $686,700

Median income: $70,577

Years: 9.73

5. Long Beach, CA

Median home value: $557,700

Median income: $60,557

Years: 9.21

6. San Jose, CA

Median home value: $854,700

Median income: $104,675

Years: 8.17

7. Boston, MA

Median home value: $540,600

Median income: $66,758

Years: 8.10

8. Miami, FL

Median home value: $322,100

Median income: $40,327

Years: 7.99

9. San Diego, CA

Median home value: $600,300

Median income: $76,662

Years: 7.83

10. Seattle, WA

Median home value: $673,100

Median income: $86,822

Years: 7.75

11. Washington, District of Columbia

Median home value: $607,200

Median income: $82,372

Years: 7.37

12. Portland, OR

Median home value: $427,500

Median income: $66,187

Years: 6.46

13. New Orleans, LA

Median home value: $227,800

Median income: $36,999

Years: 6.16

14. Denver, CO

Median home value: $395,100

Median income: $65,224

Years: 6.06

15. Sacramento, CA

Median home value: $335,900

Median income: $56,943

Years: 5.90

Data and Methodology

To rank the cities where the average household would need to save the longest to afford a down payment, we analyzed data on the 50 largest cities in America. We specifically considered two pieces of data, both from the Census Bureau’s 1-year American Community Survey:

- Median home value.

- Median household income.

We started by determining the annual savings for households by assuming they would save 20% of the median annual income. Next we determined how much a 20% down payment would cost for the median home in each city. Then we divided the estimated down payment amounts in each city by the estimated annual savings amounts for that city. The result was the estimated number of years of saving needed to afford a down payment. (This assumes that you don’t have any savings already.) Finally, we created our final ranking by ordering the cities from largest number of years to smallest number of years.

Tips for Affording a Down Payment

- Use an account with a high interest rate. There are many places where you can store your savings. One great option is a high-yield savings account. These will earn significantly higher interest than traditional savings accounts. Why would you want to earn a rate around the national average of 0.10% when you can earn an annual percentage yield (APY) of 2.25% or higher? Another option for maximizing your savings rate is to put your money in a certificate of deposit (CD). Some of the best CD rates are above 3%.

- Plan your finances in advance. If you have multiple savings goals, you’re not alone. Like many others across the country, you want to have enough to spend on the things you enjoy, save for retirement and perhaps save to support a family, all while saving for the down payment on a home. You can help yourself by prioritizing your goals and creating a strategy to execute them. If you need help, you can talk to a financial advisor to help you create a financial plan.

Questions about our study? Contact us at press@smartasset.com

Photo credit: ©iStock.com/Rawpixel, ©iStock.com/halbergman, ©iStock.com/Boogich, ©iStock.com/ChuckSchugPhotography, ©iStock.com/Andrei Stanescu, ©iStock.com/Ron_Thomas, ©iStock.com/ajcasanova, ©iStock.com/jorgeantonio, ©iStock.com/littleny, ©iStock.com/Chris Haver, ©iStock.com/MarkHatfield, ©iStock.com/lillisphotography, ©iStock.com/timnewman, ©iStock.com/Rauluminate, ©iStock.com/RiverNorthPhotography, ©iStock.com/slobo