eOption is an easy-to-use online brokerage that is designed to offer affordable trading options. The brokerage can be a good option for those wanting frequent but affordable trading options for typical stocks and funds. We’ll cover all of the most important features and fees in this review. If you’re wanting someone to automate your investments you may want to work with a financial advisor.

eOption Overview

A division of Regal Securities, Inc., eOption was created in 2007, designed to offer a more affordable way to trade options. You’ll find the lowest options commission charges here. You’ll also find a convenient trading platform, eOption Trader, with various tools and interactive features to help you trade smarter and faster.

eOption provides low commissions on options, stocks and ETFs but requires a $15 annual fee for IRAs. eOption is best for active traders who are looking for low-cost trades but it’s important to note that there are no commission-free ETFs or mutual funds at the brokerage. Here’s a breakdown of all the fees you might encounter.

Fees and Minimums Under eOption

eOption charges the lowest commissions for trading options, stocks and ETFs. Brokerage firms typically charge around $6.95 per trade, but eOption charges just $3. Market or Limit stock and ETF trades also cost a $3 commission. (Note that there is an additional fee of $6 if you make an option, stock or ETF order with broker assistance.)

In addition to commission charges and the fees listed below, keep an eye out for fees that may crop up for certain actions. For one, if you’re opening an account as an IRA, you’ll have to pay a $15 annual fee for the account. There are a number of other miscellaneous fees, including a $50 annual fee for account inactivity.

To get started with an eOption brokerage account, you’ll need to deposit at least $500. If you’re opening an eOption account internationally, you’ll need at least $25,000. You need to fund your new account within 30 days after opening or the account will be closed.

eOption Fees

| Fee Type | Rates |

| Options | – Equity or Index, Market or Limit: $1.99 per contract + $0.10 per contract – Broker-Assisted Orders: an additional $15 – Option Exercise and Assignment: $9 |

| Stocks and ETFs | – Market or Limit (Unlimited Shares): $0 – Broker-Assisted Orders: Additional $15 – Foreign stocks: $39 |

| Mutual Funds | – $5 on all mutual fund trades |

| Extended Hours Trading | – $3 trading |

| Margin Rates | – 9.95% base rate, decreasing as balance rises (as low as 6.95%) |

| ACH/Checks/Wires | – ACH Recall/Reversal/Return: $35 – Wire Transfers: $35 – Returned Checks: $50 |

| Traditional, Roth, Rollover, SEP IRAs & Coverdell ESAs | – Annual Fee: $15 – IRA Setup Fee: $0 – IRA Termination Fee: $50 |

| Simple IRAs | – Annual Fee: $45-$100 – Setup Fee: $100 – Termination Fee: $50 |

eOption Features and Services

eOption Services & Features

| Feature/Service | Details |

| Account Types | – Simple IRAs – Traditional IRAs – Roth IRAs – Rollover IRAs – SEP IRAs – Coverdell ESAs |

| Investment research tools | – Options chains and screeners – Outlines for various investment strategies – Daily market reports |

| Educational Resources | – Educational articles on options, margins, investing and money management – Options education videos – Options trading glossary – Paper Trading account |

| Customer Service | – Live online chat feature – Extensive FAQ section – Representatives available over email and phone |

You have a number of choices when opening an eOption brokerage account. In addition to standard taxable accounts, eOption allows you to open individual retirement accounts, including Traditional, Roth, Simple and SEP IRAs. These accounts are available as Corporate, Trust and Coverdell ESA accounts, as well. Just note that you cannot open Corporate, Trust, Coverdell, SEP and Simple IRAs online. Instead, you’ll have to print an account application and send it in.

For rookie traders or those who just want to try out the platform, eOption also offers a free Paper Trading account. The Paper Trading account offers the chance to trade stocks and options with $50,000 in virtual cash. Both prospective clients and existing customers can open a Paper Trading account.

If you’re not yet a customer, you’ll still need to create an account with a User ID, password and email. Prospective customers’ accounts will expire after 60 days, but you can open a real account with eOption to continue paper trading. Users can also make use of eOption’s available educational resources, including the daily 1Option Commentary, Daily Market Insights and a Weekly Event Calendar.

eOption Online Experience

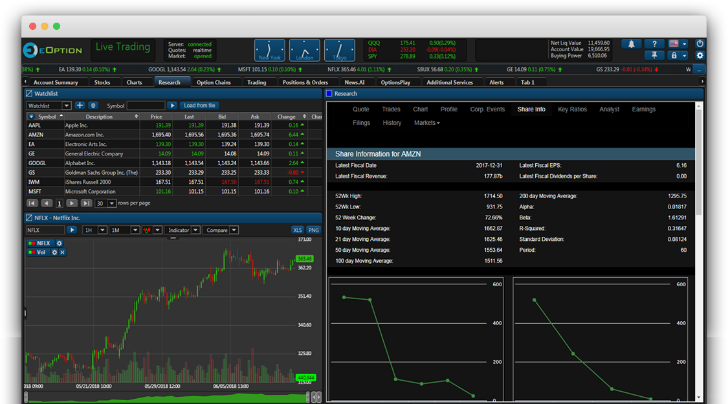

eOption customers now have access to the company’s new eOption Trader platform for a more hands-on trading experience. Through this platform, you can easily buy and sell, create a watchlist of stocks to keep an eye on, compare stocks to each other, keep up with market news and track the performance of singular stocks on an interactive graph.

You’ll also have access to research data like ratios, analyst reports, income statements and balance sheets. eOption also offers a new tool called OptionsPlay in your trading platform, which allows you to trade, explore and analyze options in one advanced interface. Should you get stuck or need some guidance in navigating this platform, eOption provides a number of helpful walkthrough videos. There are videos to walk you through charting, carrying out stock orders and entering option trades.

eOption Mobile Experience

Want to take your trading on the go? Download the eOption Mobile app so you never have to be away from the markets. You’ll have constant access to your accounts, trading platform and the order status of stocks, ETFs and options. The app also streams quotes and market news and includes an intuitive charting tool to help you make educated trades.

You can log into eOption Mobile with your User Name and password that you use on the desktop website. Once you’re logged in, you can see all the accounts you have linked to that User Name. Note that you cannot trade in extended hours on eOption Mobile.

eOption Customer Support

You can contact an eOption representative in a few different ways. During business hours, you can reach a representative through the live chat system. If you don’t need to speak to someone immediately, you can fill out a form online to send an email. To give them a call, you have a few different phone numbers available, depending on whether your call is concerning a new account or for general customer service. You can reach a representative over the phone Monday through Friday from 8:00 a.m. to 8:00 p.m. EST. You may also choose to send eOption mail at their mailing address.

Who Is eOption For?

eOption is best for active traders looking for low costs on options, stocks and ETFs. eOption charges the lowest commissions in the industry, encouraging more trading and more profit. You might do better to use the company’s mobile app for its real-time quotes, market news and the ability to make multiple order types. Still, the desktop eOption Trader platform provides valuable features and insights for investors.

eOption is also a good choice for those who want to map out their strategies before taking the plunge. With its Paper Trading accounts, eOption offers prospective clients and existing customers the chance to test out trading strategies with virtual cash. For newbie traders, it’s a good way to test out whether you have the know-how and the nerve for active trading.

How Does eOption Compare?

While no other brokerage can beat eOption’s low commissions, some come close. Ally Invest, for one, charges a low commission of $4.95 per trade, plus a $0.65 options contract fee; those rates drop to $3.95 and $0.50 if you make a lot of trades or maintain an account balance over $100,000. Plus, Ally Invest requires an opening deposit of only $100, offering the opportunity to start investing to a wider range of customers. Ally also offers the chance to trade bonds, forex and futures.

Another solid competitor with low commissions is Schwab, which charges the same fee structure on options as Ally Invest. Schwab does require a higher minimum deposit of $1,000. More consistent investors can waive this minimum, however, by setting up automatic recurring deposits of at least $100. Schwab Trading Services customers can also receive extra perks. These include customizable trading platforms online (via software or on your mobile app), trading education resources and 24/7 access to trading specialists.

Brokerage Comparison

| Brokerage Firm | Fees | Minimum | Best For |

| eOption | $1.99 + $0.10 per contract | $0 | – Active day traders – Traders who want constant access to accounts, even on the go |

| Ally Invest | $4.95 + $0.65 per contract | $0 for self-directed | – Investors with lower starting balances |

| Schwab | $4.95 + $0.65 per contract | $0 | – Schwab Trading Services account holders get further perks |

eOption: What’s the Catch?

Despite its low commissions on options, stocks and ETFs, eOption can charge some high fees on its IRAs. Opening an IRA here will cost you $15 a year. Simple IRAs can cost you even more, between $45 and $100 to own each year. Given these fees, you may be better off just opening a taxable account with eOption.

eOption offers its own trading platform, eOption Trader. It has a tabbed interface, allowing you to move between trading stocks, trading options, checking out asset performance, researching various stocks and more. There’s even a separate platform for options trading called OptionsPlay. Still, some experts and day traders might find these online features lacking in real-time updates, market news and multiple order tools for optimal active trading.

Disclosures

eOption is a division of Regal Securities, Inc. which currently has 13 disclosures according to the Financial Industry Regulatory Authority (FINRA). Nine of these disclosures are for regulatory events and four are due to arbitration.

The last disclosure, a regulatory event, occurred in Arkansas in 2017 and involved Regal Securities, Inc. failing to establish and enforce certain supervisory procedures, resulting in an agent engaging in outside business activity. You can find more details about the company’s disclosures at brokercheck.finra.org.

Bottom Line

If you’re looking for the lowest commissions for trading options, stocks and ETFs, eOption is your best bet. The eOption Trading platform makes it possible to trade all three asset classes, and the OptionsPlay analysis suite will let you take your trading to the next level. And if you’re new to trading, eOption’s paper trading account will let you try your hand at trading without risking real money.

Tips to Get Into Investing

- Before you start getting into advanced trading strategies, you should consider speaking with a financial advisor. The right advisor can guide you toward a portfolio and a financial plan that can help you reach your goals and save for retirement. Finding a financial advisor doesn’t have to be hard. SmartAsset’s free tool matches you with up to three vetted financial advisors who serve your area, and you can interview your advisor matches at no cost to decide which one is right for you. If you’re ready to find an advisor who can help you achieve your financial goals, get started now.

- Not quite sure where to start? Don’t worry, you’re not alone. There are a number of investment products out there to help ease you into the complicated world of investing. Stash allows you to invest in causes you care about, while also breaking down your investments into simple graphics. For an even simpler approach, Acorns automatically invests your spare change.

Photo credit: eOption, ©iStock.com/Yozayo