Credit cards are a powerful personal finance tool. Used correctly they can unlock tremendous rewards, worth thousands of dollars. Used incorrectly and they can lead to spiraling debt and thousands of dollars lost in high interest payments. With this in mind SmartAsset looked at which places of the U.S. are the most reliant on their credit cards.

Check out the best balance transfer credit cards.

In order to find the places where residents are most reliant on their credit cards, SmartAsset analyzed data on credit card debt, median individual income, credit utilization rate, late payment rate, average number of open credit cards and credit card debt as a percent of overall debt. To see where we got our data and how we put it together, check out our data and methodology section below.

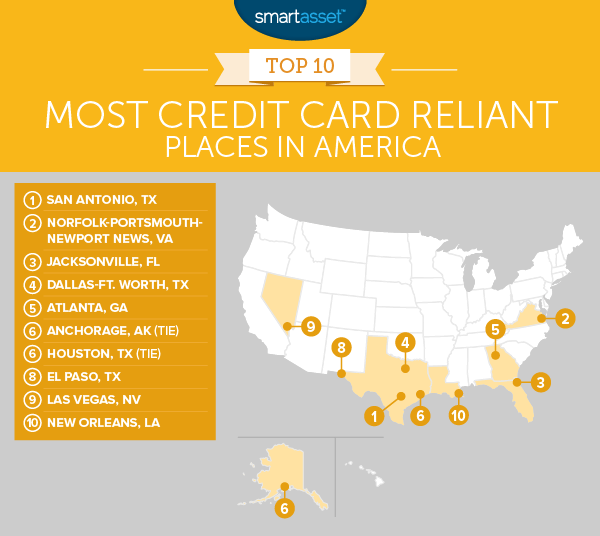

Key Findings

- High late payment rates – One of the most common credit card mistakes people make is late payments. Our data shows that, in many American cities, people are not making their credit card payments on time. On average residents in our top 10 make over 0.5 late payments per billing cycle.

- Responsible Iowans – The Hawkeye State is home to three of the bottom 10 least credit card reliant places in our study. Sioux City, Des Moines-Ames and Cedar Rapids-Waterloo-Iowa City-Double are metro areas with extremely low credit card debt-to-income ratios.

- Florida and Texas – Residents in these two states seem to enjoy using their credit cards. Both states have five cities in the top 20. These cities have high credit card utilization rates.

1. San Antonio, Texas

It’s always best to pay your credit card bills on time. If you don’t, you run the risk of paying a ton in extra interest payments or in late fees and penalties. Residents of San Antonio have struggled with paying their credit card bills on time, according to our data. San Antonio residents make an average of 0.54 late payments per billing cycle. That’s a top 20 rate in this study.

When San Antonio residents do go into debt, they also tend to lean on their credit cards. Just over 15% of San Antonio residents’ non-mortgage debt is tied up in their credit cards, on average, the seventh-highest percent in our study.

2. Norfolk-Portsmouth-Newport News, Virginia

Some folks in the Norfolk-Portsmouth-Newport News metro area are pushing their credit boundaries. The average credit utilization rate in the area is 36%, the third-highest in our study. Keep in mind that a high utilization rate (above 30%) can hurt your credit score. Our data also shows that on average over 16% of Norfolk-Portsmouth-Newport News residents’ non-mortgage debt is held in credit cards. That’s the fourth-highest rate in the study.

The good news is that despite leaning heavily on their credit cards, Norfolk-Portsmouth-Newport News residents seem to be doing an OK job making payments. This area has an average late payment rate of 44%, that’s the third-lowest in the top 10.

3. Jacksonville, Florida

Scoring only one point less on our overall index than Norfolk-Portsmouth-Newport News, is Jacksonville, Florida. Jacksonville scores in the top 20 in two metrics: utilization rate and credit card debt as a percentage of non-mortgage debt.

But Jacksonville residents are also reliant on their credit cards in other ways. For example, if the average Jacksonville resident wanted to pay off his credit card debt in its entirety, he would need to fork over 22% of his annual income. That is the 34th-highest rate in our study.

4. Dallas-Fort Worth, Texas

Relying too much on credit card debt can have adverse long-term affects. Some data coming out of Dallas-Fort Worth, suggests that residents there may be relying on their credit cards too much. This city ranked fourth for credit card debt as a percentage of overall debt. Dallas-Fort Worth residents also ranked in the top 20 for average number of open credit cards. The average resident has 2.46 credit cards.

5. Atlanta, Georgia

Atlanta residents had above average scores in every metric. In particular, residents tend use up large chunks of their credit limit: the average utilization rate is just under 34%. Many experts suggest keeping your credit utilization rate below 30%. Any higher and it can negatively impact your credit score. For Atlanta residents looking to lower their utilization rates, this can be achieved by paying off existing credit card or raising your credit limit. If you’re thinking about increasing your credit line, you may want to proceed with caution. You wouldn’t want to spend too much money and not be able to pay your bills.

6. (tie) Anchorage, Alaska

Alaska has a relatively high cost of living so it may not be a surprise to learn that residents of the state’s largest metro area are racking up credit card debt. The average Anchorage resident has about $7,520 in credit card debt. Residents earning Anchorage’s median income would need to spend just under 23% of their income to eliminate all of that credit card debt. For that metric, Anchorage ranks 27th in the study and third in the top 10.

All that credit card debt is not doing good things for Anchorage residents’ utilization rate either. On average, Anchorage residents have the 11th-highest utilization rate in the country.

6. (tie) Houston, Texas

Tied with Anchorage at sixth is Houston. Houston residents earn just under $30,000 annually, on average. This helps keep their rate of debt as a percent of income relatively low. But in terms of other credit card reliant metrics they score high.

For example, Houston residents have the 11th-highest rate of credit card debt as a percent of non-mortgage debt, on average. The bad news for Houston residents is that they don’t tend to pay their credit card bills on time. Only 45% of payments are made on time in Houston, according to our data.

8. El Paso, Texas

One of the most important things to consider when using your credit card is can you afford what you’re purchasing? El Paso residents seem to be pushing the limit of what they can afford with their credit card debt. On average, El Paso residents have so much credit card debt that it would take 25% of their annual income to pay it off.

Another problem with racking up credit card debt is that you run the risk of not being able to pay your bill when it arrives. El Paso residents, on average, have around 0.56 late payments per billing cycle.

9. Las Vegas, Nevada

Sin City ranks ninth on our list of places most reliant on their credit cards. Las Vegas residents have high utilization rates – above 34%, on average. They also have an average late payment rate of around 50%.

On other metrics, however, Las Vegas scores better than many other cities. For example, average credit card debt is equal to about 20% of the average resident’s annual income, the 89th-highest rate in our study.

10. New Orleans, Louisiana

Credit card debt in New Orleans is pretty high. Our data shows that average resident in New Orleans has credit card debt just under $5,800. However New Orleans residents are only bringing home $26,000 per year, on average. Overall credit card debt represents 22.3% of the average New Orleans resident’s income. That’s the 30th-highest rate in the study.

Other indicators also suggest New Orleans residents are reliant on their credit cards. For example, they have an average utilization rate just under 34% and make 0.52 late payments per billing cycle.

Data and Methodology

In order to find the places most reliant on their credit cards we looked at data on 202 different U.S. metro areas. Specifically we looked at data on the following five factors:

- Credit card debt as a percent of income. Data on average credit card debt comes from Experian’s 2016 state of credit report. Data on median individual incomes comes from the U.S. Census Bureau’s 2015 1-Year American Community Survey.

- Average utilization rate. Data comes from Experian’s 2016 state of credit report.

- Average late payment rate. This is the average number of late payments per billing cycle. Data comes from Experian’s 2016 state of credit report.

- Average number of open credit cards. Data comes from Experian’s 2016 state of credit report.

- Credit card debt as a percent of non-mortgage debt. Data on both average credit card debt and average non-mortgage debt comes from Experian’s 2016 state of credit report.

We then ranked each metro area in each of the five metrics. Then we found each city’s average ranking giving equal weight to every metric. We used this average ranking to create our final score. The metro area with the best average ranking received a 100 while the city with the lowest average ranking received a 0.

Tips on Using Credit Cards Responsibly

Credit cards work like short-term loans with extremely high interest rates. So in order to make sure you avoid costly interest payments you should be sure to use your credit cards responsibly. In part, that means only buying things you can afford to pay in full and on time.

If you cannot make the full payment each month, paying as much as you can or at the very least the minimum payment, on time is the next best strategy. By not paying it in full you are racking up interest payments, and by the time you do finally pay it off you may end up paying for items many times over.

People with a lot of debt spread out over several credit cards may want to consider a balance transfer credit card. Balance transfer credit cards allow you to transfer debt from one credit card account to another. So it’s a way to consolidate debt to one account, ideally with a lower interest rate, and work on paying off that debt. With many of the best balance transfer credit cards, consumers pay 0% interest for a limited time period.

If you are already doing all of those things and if you don’t have debt to pay off, credit cards can be a good way to build credit history and raise your credit score. Remember a high credit score allows you access to benefits like the best mortgage rates and rewards credit cards.

Questions about our study? Contact us at press@smartasset.com.

Photo credit: ©iStock.com/praetorianphoto